Tail Coverage Insurance Policy Definition

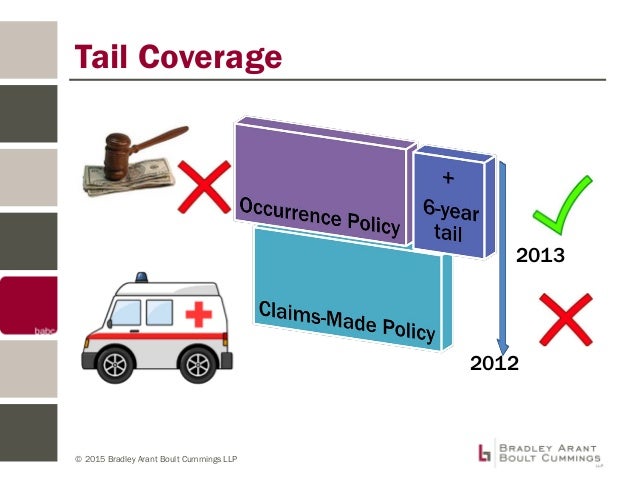

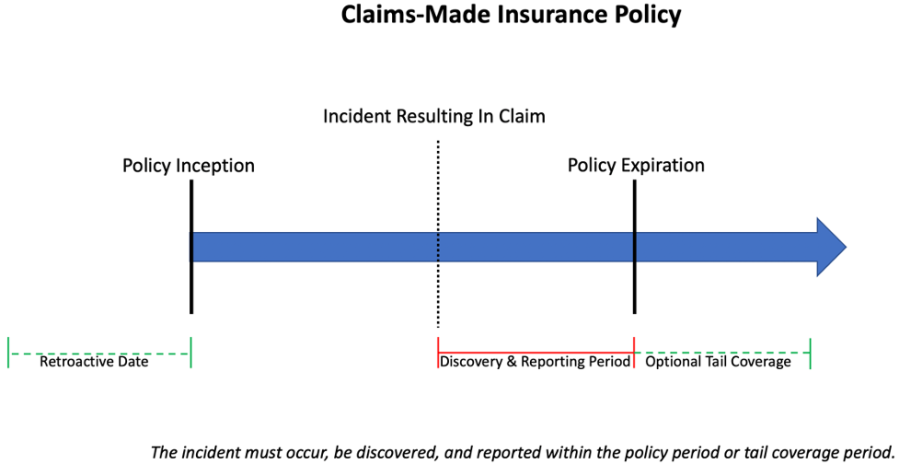

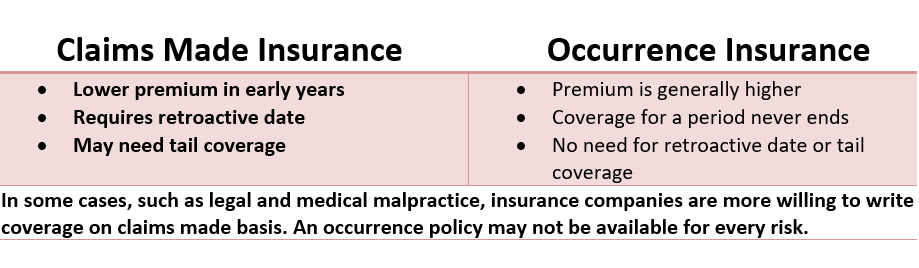

This coverage is also known as an extended reporting period. Tail coverage is an endorsement also called a rider typically found within a claims-made policy such as errors and omissions insurance EO or directors and officers insurance DO.

If I Change Insurers Will I Lose My Tail Cover Retroactive Cover Explained Tego

It applies to claims-made insurance policies and typically involves paying your insurer an additional fee.

Tail coverage insurance policy definition. These policies require the claim to be brought while the policy remains in effect. Tail coverage is an endorsement or an addition to your insurance that allows you to file a claim against your policy after it expired or was canceled. Tail Policy has the meaning set forth in Section 508a.

And since this type of policy is restrictive in nature and very expensive most companies that hire doctors have this kind of issues settled and discussed at the start of employment. 0 February 7th 2012 Whether carrying medical malpractice insurance on your own as a private practice physician or as an employee of a group or hospital tail coverage should be a top priority when considering any changes to your coverage. The claim occurred while the practitioner was practicing on behalf of the practice The practitioner was notified that the claim was pending while the practitioner was engaged in that practice.

Liability insurance that extends beyond the end of the policy period of a liability insurance policy written on a claims-made basis. Everything Physicians Should Know About Tail Malpractice Insurance Coverage. Other forms of insurance cover employers public and product liabilityHowever various professional services and products can give rise to legal claims without causing any of.

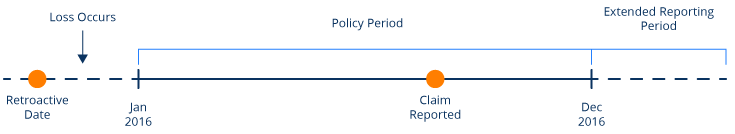

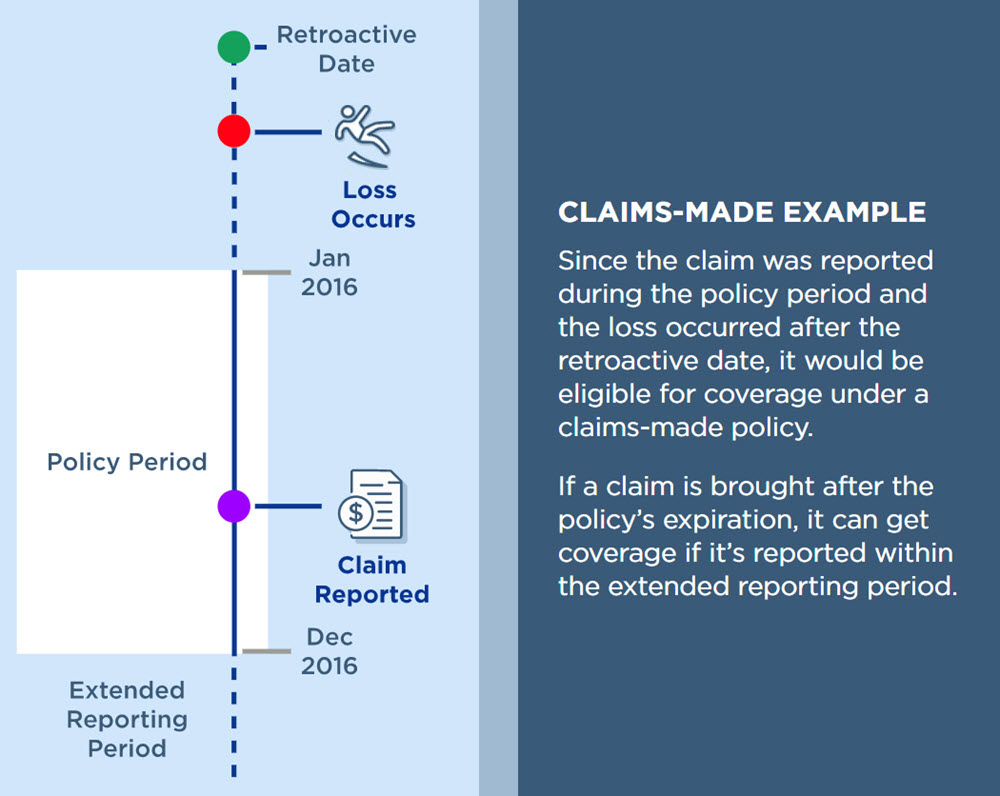

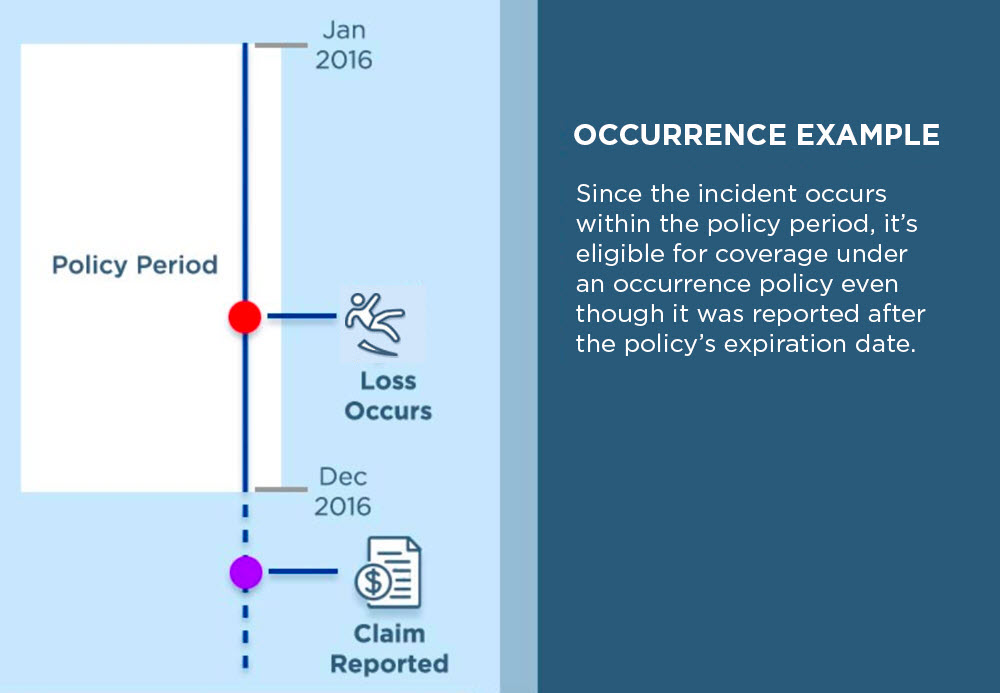

Liability claims are often made long after the accident or event that caused the injury. Doctor As insurance policy is in effect from. Essentially the DO insurance policy is held open for a certain number of years to address claims that may arise after the deal is closed.

Tail coverage is meant to address this problem by providing coverage for medical malpractice claims made after an insurance policy has ended. Tail coverage insurance policy definition. Its especially useful when buying from a firm selling or closing down an agency.

A tail policy covers what would otherwise be a gap in coverage for directors and officers after the sale of a. However the extension only applies to wrongful acts that happened while the malpractice insurance policy was still in force and it does not apply to wrongful acts that occured after the malpractice. In contrast to a standard policy tail coverage provides protection for medical malpractice claims that are reported after the providers policy expired or was cancelled.

Here is an example of how tail coverage works. Tail Insurance allows the purchaser to continue to cover EO claims after the policy has expired. Tail coverage is required by claims-made professional liability insurance especially if.

This policy endorsement is also known as an extended reporting period. Insurance Coverage means any health plan life insur- ance long-term care insurance long-term disability insur- ance or property and casualty insurance administered as a PEBB benefit. Tail coverage is a part of how your business insurance coverage works if its written on a claims-made form.

Tail Coverage a provision found within a claims-made policy that permits an insured to report claims that are made against the insured after a policy has expired or been canceled if the wrongful act that gave rise to the claim took during the expiredcanceled policy. Tail coverage requires that the insured pay additional premium. It gives your business protection for claims that are reported after your insurance policy ends.

This policy endorsement is also known as an extended reporting period. Many liability policies are written on a claims-made basis which means the insurer pays only. Tail coverage insurance is a provision within an insurance policy that allows the insured to make claims after a policy has expired for acts that occurred while the policy was still valid.

Pin on Vintage and Main. It differs from typical medical malpractice insurance policies which are known as claims-made policies. An extended reporting endorsement often called an ERE or tail coverage is an endorsement to your policy that provides a period of time to make or report a claim after a policy expires or is cancelled.

Tail coverage is another name for an extended reporting period. Definition of Tail coverage. Bobtail liability insurance is a type of vehicle liability coverage that covers a vehicle when not in use for business purposes.

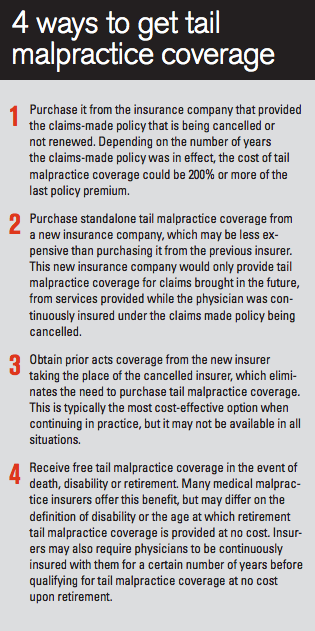

Most tail coverage policies are very expensive and could reach up to 200 more than the standard medical malpractice insurance policy. Tail coverage extends the reporting period of malpractice insurance so that medical practitioners can report a wrongful act even after their malpractice insurance lapsed or was cancelled. Tail Coverage also known as Extended Reporting Coverage ERP is an important type of insurance add-on for an agencys Errors and Omissions EO policy.

The topic of tail malpractice insurance coverage. The primary reason for professional liability coverage is that a typical general liability insurance policy will respond only to a bodily injury property damage personal injury or advertising injury claim. The answer is tail or runoff coverage.

Installment Tail Coverage the purchase of an extended reporting period ERP also referred to as tail coverage for a claims-made liability policy in 1-year increments. DO Tail Policy means a directors and officers liability and fiduciary liability insurance coverage for all directors officers and employees of Company that covers on a primary basis acts or omissions occurring on or prior to the Closing including with respect to acts or omissions occurring in connection with this Agreement and the consummation of the transactions contemplated hereby with a coverage period of. Tail coverage has traditionally been offered as an extended reporting period endorsement by the current insurance carrier but may also be available as a stand-alone tail policy from other insurance carriers.

Malpractice A malpractice insurance rider or supplement to a claims-made policy that provides coverage for an incident that occurred while the insurance was in effect but was not filed by the time the insurer-policyholder relationship terminated. Tail coverage is a type of insurance that is designed to cover claims arising before the termination of a claims-made insurance policy but which are reported afterwards. The answer is tail or runoff coverage.

This coverage extends the DO insurance policy for a certain period of time beyond the standard policy period. Most insurance policies cover claims made as long as the policy is in place.

Mind The Gap With Between Occurrence And Claims Made Policies

Oamic Legal Malpractice Insurance What Exactly Is Tail Coverage And How To Know If You Need It

Do You Need Malpractice Tail Coverage

Claims Made Prior Acts And Tail Coverage

Claims Made Vs Occurrence Progressive Commercial

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

Tail Insurance Coverage What Is It Landesblosch

Claims Made Vs Occurrence Insurance Policies Embroker

What S The Difference Between Occurrence Claims Made Insurance

Tail Coverage What Is It How Does It Work And When Am I Eligible

What Is E O Insurance Tail Coverage And How Does It Work In Real Estate Vaned

Claims Made Vs Occurrence Insurance Policies Embroker

Tail Coverage Definition Techinsurance

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

Non Practicing Extensions In Professional Liability Insurance Policies Expert Commentary Irmi Com

What Is Tail Insurance Medpli Professional Liability Insurance

Tail Insurance Faqs Aegis Malpractice Solutions

Dental Malpractice Insurance Types Cost Lawsuit Reasons

Posting Komentar untuk "Tail Coverage Insurance Policy Definition"