Fdic Insurance Coverage Explained

FDIC insurance is backed by the full faith and credit of the United States government. The FDIC recognizes different types of ownership categories that qualify for insurance coverage.

Deposit Insurance Offers A Safe Haven The Cpa Journal

FDIC insurance covers depositors accounts at each insured bank dollar-for-dollar including principal and any accrued interest through the date of the insured banks closing up to the insurance limitThe FDIC does not insure money invested in stocks bonds mutual funds life insurance policies annuities or municipal securities even if these investments are purchased at an insured bank.

Fdic insurance coverage explained. Learn about the FDICs mission leadership history career opportunities and more. Understand the three most common personal ownership categories and how to structure your accounts to maximize your FDIC insurance coverage. Runs on the bank can be catastrophic for the economy as a whole so this insurance is provided to make.

FDIC insurance covers all deposit accounts including. EXPLANATION OF FDIC COVERAGE The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States government that protects against the loss of insured deposits if an FDIC-insured bank or savings association fails. Insuring your bank deposits.

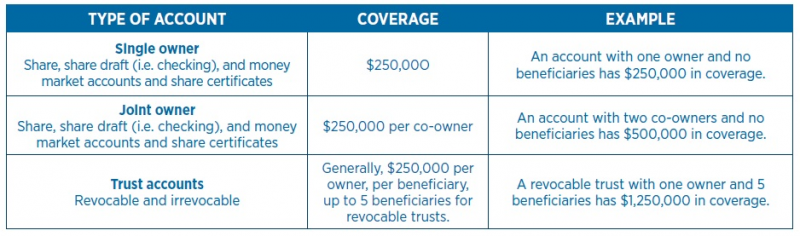

The FDIC insures the money in deposit accounts up to 250000 per ownership category. What is the FDIC. To get FDIC insurance protection the account must be an insured deposit account in an FDIC-insured bank.

Treasury Bills and other investment accounts. FDIC insurance is backed by the full faith and credit of the United States government. What FDIC Does and Does Not Cover.

The Federal Deposit Insurance Corporation FDIC is an independent agency created by the Congress to maintain stability and public confidence in the nations financial system. You want your bank to be FDIC-insured to guarantee the money you keep in your accounts will be available to you should the bank fail. Federal deposit insurance goes to the heart of the FDICs mission.

Moreover he also said that FDIC will also be responsible for keeping a check on the DIF ensuring that the Deposit Insurance Fund is not jeopardized in any possible way. To promote confidence and stability in the nations financial system. The Federal Deposit Insurance Corp FDIC which is a leading banking regulator in the US is currently assessing whether certain stablecoins are eligible for its insurance coverage.

FDIC insurance covers deposit accounts checking savings and money market accounts and certificates of deposit and kicks in only in the event a bank fails. First you can deposit your money at different banks. FDIC insurance does not cover other financial products and services that banks may offer such as stocks bonds mutual funds life insurance policies annuities or securities.

The FDIC Federal Deposit Insurance Corporation is an independent agency of the United States government that protects you against the loss of your insured deposits if an FDIC-insured bank or savings association fails. Not all bank accounts at an FDIC-insured bank will be deposit accounts. An explanation of the deposit insurance offered by the FDIC to banks and how to structure accounts to get maximum coverage.

FDIC stands for Federal Deposit Insurance Corporation. This coverage does not extend to stocks bonds annuities safe deposit boxes and contents US. Deposits include checking accounts NOW accounts savings accounts money market accounts individual retirement accounts IRAs and certificates of deposit CDs.

Since the FDIC insurance limit of 250000 is per ownership category at each bank you can easily maximize your coverage in one of two ways. Money market deposit accounts. Since the FDIC was established in 1933 no depositor has lost a penny of.

This video helps you un. The Federal Deposit Insurance Corporation FDIC is an independent agency created by the Congress to maintain stability and public confidence in the nations financial system. It was formed in the 1930s in response to the banking crashes that accompanied the Great Depression.

Its designed to keep America confident in its banks but it also provides real-world safeguards for your money by doing precisely what its name implies. FDIC deposit insurance enables consumers to confidently place their money at thousands of FDIC-insured banks across the country and is backed by the full faith and credit of the United States government. Government that protects and reimburses your deposits up to the legal limit of 250000 in the event your FDIC.

The Federal Deposit Insurance Corporation was established in 1933 to allow people who deposited money into bank accounts to feel confident that they were secure even in cases where the bank itself is insolvent. Phillips explained that the insurance money used to sponsor a stablecoin in the future will be spent from the DIF and the FDIC has to make sure that the process is established on legal grounds. The Federal Deposit Insurance Corporation FDIC is an independent agency of the US.

Learn about the FDICs mission leadership history career opportunities and more. FDIC insurance protects deposits from loss up to the FDIC insurance limit including principal and accrued interest. FDIC stands for the Federal Deposit Insurance Corporation.

The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States government that protects the funds depositors place in banks and savings associations. FDIC deposit insurance is backed by the full faith and credit of the United States government. Deposit Insurance Coverage Overview.

Medicare 101 Basics Explained Turning 65 In 2020 Easy Tutorial Youtube Medicare Easy Tutorial Health Insurance Broker

Fdic Insurance And How It Works Credit Com

Fdic Insurance Deposit Limits What You Should Know

How Fdic Insurance Works Synchrony Bank

Understanding Sipc And Fdic Coverage Ameriprise Financial

Annuity Formula Annuity Formula Annuity Economics Lessons

What Does Fdic Insured Mean And How Does It Protect Your Money

What Is Fdic Insurance Huntington Bank

Understanding Sipc And Fdic Coverage Ameriprise Financial

Fdic Learning Bank About The Fdic

Vector Blackjack Table Layout Detailed Black Jack Casino Table With Icons Sponsored Table Layout Vector Blackjack Det Blackjack Jack Black Casino

1940 Reconstruction Finance Corporation Rfc Cartoon Set Original Black And White Cartoon Cartoon Finance

Posting Komentar untuk "Fdic Insurance Coverage Explained"