Change Insurance Cover Australian Super

Change your Income Protection waiting period or benefit payment period change your work rating. 20742 0921 page 1 of 12 Use this form to apply for new cover or to start increase reduce change or cancel your cover to suit your needs.

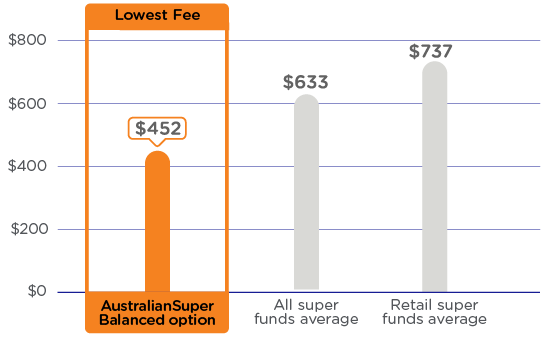

Super With Low Fees Our Fees Costs Australiansuper

Fixed cover remains the same unless you change it.

Change insurance cover australian super. Insurance in super is an effective way to protect your future and the future of your family by giving you access to financial support if something happens. Eligible members receive age-based Death Total Permanent Disablement TPD and Income Protection cover. And when your super balance reaches 6000.

It changes as you age. Note if your cover has a premium loading the premium loading applies as a factor to. AustralianSuper will only make changes to each type of cover you change in this form.

Tom is 30 when he joins AustralianSuper. In addition super funds may have their own rules that require the cancellation of insurance on super accounts where balances are too low. You have the same duty before you extend vary or reinstate your insurance cover.

The government has made two sets of changes to insurance in superthe Protecting Your Super Package PYSP and Putting Members Interests First PMIF. To help you understand how the new insurance premiums may affect you weve provided some examples of each type of cover below 2. Most super funds offer life total and permanent disability tpd and income protection insurance for their members.

Most of us are underinsured. Apply for new cover. You may also be eligible for insurance in super without having to take medical tests or provide evidence of good health to the insurer.

The aim of the super changes is to prevent costly fees which bank up over time eating up balances on inactive accounts. This means the age-based basic cover he will automatically receive for Death. Members who are 25 or older when they join will keep.

Insurance changes from 1 March 2021 Were making some changes to insurance cover through HESTA so we can keep it competitively priced and to better reflect the needs of most of our members. But if they make any changes to their cover including changing their work rating benefit period or waiting period their cover will no longer increase automatically as they get older. In January 2020 we wrote about the significant changes coming to new income protection insurance policies in Australia with some of these changes due to take effect from 1 October this year and at least one measure delayed for 12 months.

Sourcesupplied holding life insurance in a superannuation fund is about to get trickier. If you wish to cancel all cover under AustralianSuper you should complete Section 1 and 3 of this form and sign the Declaration. Insurance calculator australian super.

Income Protection cover with their super account. Insurance through your super account may be a tax-effective way to cover the cost of insurance and as the premiums are paid from your super account there may be no impact to your take-home pay. The reason for this change is to satisfy new regulatory requirements that govern the insurance cover which.

You can also cancel all or part of your cover. But for many superannuation is the only place Australians have access to. Life insurance australian super.

The cost is automatically deducted from your super account. Under the governments Putting Members Interests First changes from 1 April 2020 insurance through super cannot be provided to a member if their super account balance has never reached 6000 since 1 November 2019 if the member has not opted in to keep their cover. You can find out more about income protection cover through australiansuper by reading our insurance in your super guide.

Change your cover type. This is a change to the definition of TPD for contributing members who receive a default TPD cover on or after 1 July 2014 and who then make a benefit claim on invalidity grounds you will be assessed against a modified definition of TPD. It starts once youve turned 25.

Basic cover is age-based and is designed to provide a minimum amount of cover for changing needs as you get older. This cover provides a basic level of protection if you die or become ill or injured. AustralianSuper will only make changes to each type of cover you change on this form.

Your cover is age-based so the amount and cost of it will change as you get older. Many superannuation plans include insurance as part of their offer. 1 Actual rate of increase varies depending on your age and cover type.

Increase your cover maximum limits apply decrease your cover. This cover provides a basic level of protection if you die or become ill or injured. And youre receiving employer contributions age limits and other conditions apply.

For more information download New insurance premiums - 1 October 2020 PDF 163 KB. Log into your account or use the Change your insurance form to. Below you can choose to opt in to opt out of apply for or change your level of insurance cover in Equip.

Insurance Alert - Major changes coming to income protection cover from 1 October 2021. The age-based age but the fixed amount will remain the same. Cover will increase to the amounts in the table above.

Follow the simple 3 steps to see the difference an income from super can make. Also after its transferred your total cover cant exceed the following maximum cover amounts. These changes are aimed at making sure your super savings arent reduced by the cost of your insurance that you may not need or be able to claim on.

Protection cover you can transfer is 20000 a month. Superlifes australian super transfer service. Find out how much insurance cover you may need and how much it will cost.

Here are some examples that illustrate the change in cost for members in AustralianSuper Plan with basic default cover based on their age work rating and Income Protection benefit payment period. The Insurance in your super guide. This is where the member adds a fixed amount on top of their age-based cover.

AustralianSuper provides most members with basic insurance cover with their super account. You still only pay what it costs us to provide your cover. You can also apply to change your individual work rating and Income Protection waiting period andor benefit payment period.

If you do not indicate a change to a type of cover you already have the amount of your existing cover will remain the same. AustralianSuper doesnt make any profit from the insurance we provide. Change insurance cover Death and total and permanent disablement TPD cover Cover applies automatically when you meet Equips eligibility and cover conditions unless you have opted out of it previously.

Life insurance is often referred to as death cover. Age-based cover is designed to provide a minimum amount of cover for changing needs as. Income protection insurance australian super.

Under the law super funds will cancel insurance on inactive super accounts that havent received contributions for at least 16 months.

Australiansuper Productreview Com Au

Life Insurance Through Super Pros Cons Canstar

A Positive Year For Your Super Returns Australiansuper

20 Disadvantages Of Life Insurance Through Super Insurance Watch

20 Disadvantages Of Life Insurance Through Super Insurance Watch

Industry Super Australia Employees Location Careers Linkedin

Super Funds In Sights At Royal Commission Adviser Ratings Adviser Ratings

Australiansuper Posts Facebook

Super Insurance Insurance Through Super Australiansuper

Australiansuper On The App Store

Change Or Cancel Your Cover Australiansuper

How To Change Super Funds Canstar

20 Disadvantages Of Life Insurance Through Super Insurance Watch

20 Disadvantages Of Life Insurance Through Super Insurance Watch

Australiansuper Apps On Google Play

Tobacco Free Finance Signatories And Supporters Unep Fi Principles For Sustainable Insurance

Climate Change Australiansuper

Australiansuper Review Performance Fees Finder Com Au

Posting Komentar untuk "Change Insurance Cover Australian Super"