Deposit Insurance Coverage Meaning

The most common employee benefit plans include. Deposit insurance program can provide order in winding up the affairs of a failing institution and can thus facilitate the establishment of an effective exit mechanism.

What Is The Hipaa Full Form Hipaa Stands For Hipaa Meaning Hipaa Defined Definition Of Hipaa What Do Hipaa Health Care Insurance Health Insurance Coverage

An explicit deposit insurance scheme information is provided on the characteristics of the DIS such as type management coverage funding and payouts.

Deposit insurance coverage meaning. Deposit insurance exists in order to reduce pressures that might result in bank runs. FDIC insurance is backed by the full faith and credit of the United States government. Demand deposits checking accounts of a type that formerly could not legally pay interest and negotiable order of withdrawal accounts NOW accounts ie savings accounts that have check-writing privileges.

PDIC provides a maximum deposit insurance coverage of PhP500000 per depositor per bank. Deposit insurance systems should have coverage rules that limit the scope and level of coverage and that can under certain circumstances instill depositor discipline. It is further clarified that the deposit held in the name of the proprietary concern where a depositor is the sole proprietor and the amount of Deposit held in his individual capacity are aggregated and insurance cover is available upto rupees five lakhs in maximum.

Since the FDIC was established in 1933 no depositor has lost a penny of. Deposit insurance coverage limits are applied separately to the deposits held in each credit union. Deposits are considered valid upon the determination by the PDIC based on bank records that the deposits were made with a corresponding inflow of cash.

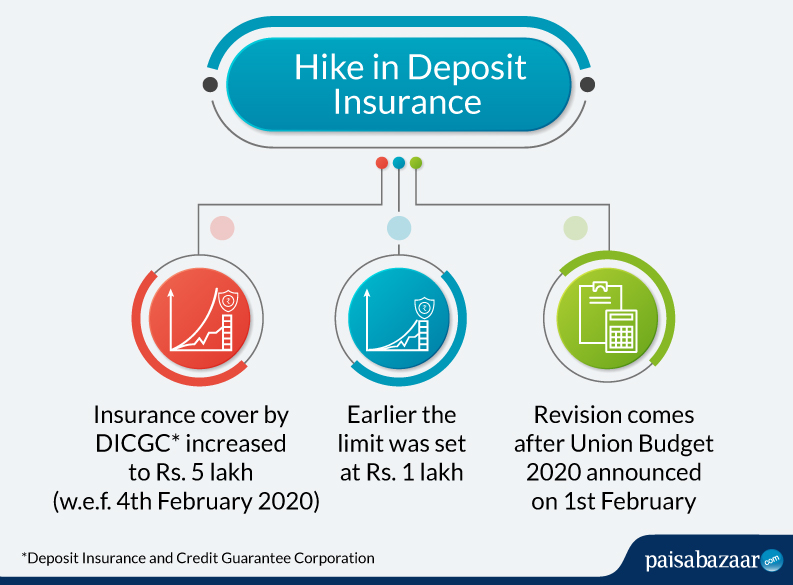

In India the deposit insurance activity is done by an RBI subsidiary called Deposit Insurance Corporation. 25 rows Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors in full or in part from losses caused by a banks inability to pay its debts when due. It is mandatory by law and is.

Your PDIC insurance coverage will not increase and will be up to P500000 in total. All types of deposits like savings deposits term deposits and RDs are covered by DICGC. Commercial and Islamic banks that are member institutions of PIDM are also referred to as member banks.

For recent years we add information on deposit coverage increases government guarantees on deposits and non-deposit. Accounts maintained in the same right and capacity for a depositors benefit whether in his own name or in the name of others are covered by deposit insurance. The Deposit Insurance System DIS in Malaysia is administered by PIDM.

Deposit insurance systems are one component of a financial system safety net that promotes financial stability. The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States government that protects the funds depositors place in banks and savings associations. Receivership of Closed Banks.

If I have deposits in different credit unions are deposits in each insured separately. FDIC deposit insurance covers deposit accounts which by the FDIC definition include. A deposit insurance is essentially the assured amount a bank depositor gets in the case that the bank cannot fulfill its obligations.

A system in which payments are made by banks to an organization that would pay a banks customers. Deposit insurance is a protection cover available for bank depositors if the bank fails financially and go for liquidation. Even if the amount deposited in the joint account exceeds 500000 PHP the maximum deposit insurance amount is still 500000 PHP.

This definition is taken from section 33 of the Employee Retirement Income Security Act of 1974 ERISA. The Deposit Insurance Scheme covers deposits in SGD held in standard savings current or fixed deposit accounts. It also covers SGD monies placed with any scheme member under the Supplementary Retirement Scheme CPF Retirement Sum Scheme and CPF Investment Scheme.

FDIC Pass-Through Deposit Insurance In general deposit insurance is provided to depositors at an Insured Institution based upon the rights and capacities in which deposits are maintained by the depositor at the Insured Institution. The deposit insurance coverage is not determined on a per-account basis. What is deposit insurance.

The type of account whether checking savings time or other form of deposit has no bearing on the amount of insurance coverage. Deposit insurance is made by a government-sponsored organization such as the FDIC. The Deposit Insurance System DIS is a system established by the Government to protect depositors against the loss of their insured deposits placed with member institutions in the event of a member institution failure.

Regulatory discipline can also be imposed by deposit insurance design features that. To pay claims on insured deposits PDIC builds up the Deposit Insurance Fund DIF primarily through assessments of banks at an annual flat rate of 15 of 1 of their total deposit liabilities. The insurance coverage of 500000 PHP will be equally divided between the owners of the joint account unless stated otherwise in the deposit documents.

For purposes of deposit insurance coverage the term employee benefit plan means an employee welfare benefit plan or an employee pension benefit plan or a hybrid of the two. It is easy to underestimate the value of deposit insurance when times are good. When times are bad governments often re-evaluate the need for such arrangements.

Deposit Insurance is a system that protects depositors whether individuals or businesses against the loss of their insured deposits in the unlikely event of a member bank failure. The deposit insurance coverage applies to the combined total of your deposits in any one member credit union.

Understanding Sipc And Fdic Coverage Ameriprise Financial

Financial Risk Pyramid Speculative Investment Tools Investment Tools Investing Finance Investing

Financial Literacy Understanding Calculating Compound Interest Personal Finance Compound Interest Math Finance Financial Literacy

See How Much You Could Save On Homeowners Or Renters Insurance With Geico Tenant Insurance Renters Insurance Renters Insurance Quotes

Untitled Project 23 Car Insurance Insurance Ads

Insurance Cover Meaning Importance And Types Scripbox

Pin On All About Ways To Save On Everything

Banking Nice Clean Look Gcbaz Com Banking Bank Money Management

How Deposit Insurance Works Cdic Ca

Find Best Crop Insurance Plans With Maximum Benefits In 2020 Crop Insurance Insurance Policy Crop Protection

Philippine Deposit Insurance Corporation Official Website

Car Insurance For Suspended License With Full Coverage Suspended License Car Insurance Insurance

Forum Learn English Learning Road Signs Traffic Signs And Meanings Road Signs All Traffic Signs

Pin By Fateme On Life Insurance In 2021 Life Insurance Marketing Critical Illness Insurance Life Insurance Sales

Pdf Deposit Insurance Around The World A Comprehensive Analysis And Database

A Car Insurance With No Deposit Policy Is Your Dream Landing No Deposit Car Insurance Quotes In Roanoke Va 24001 Car Insurance Car Insurance Tips Car

Philippine Deposit Insurance Corporation Official Website

Dicgc Deposit Insurance Coverage Increased To Rs 5 Lakh I Paisabazaar

Philippine Deposit Insurance Corporation Official Website

Posting Komentar untuk "Deposit Insurance Coverage Meaning"