Hull Coverage Insurance Policy

The highest available liability limits. It gives assurance to shipowners against hull machinery and onboard equipment damages in the event of any perils confronted while on the water including an accident with another vessel natural obstacles and other structures as well as storms and other natural disasters.

This typically includes damages sustained during take off and taxi.

Hull coverage insurance policy. The insurance provides financial protection in case of any damage to the vessels body hull and or the machinery due to risks covered by the policy. Hull insurance also includes any fixtures attached to the hull of the ship as. Hull coverage is typically subdivided to address aircraft while in motion and while not in motion.

Aircraft liability coverage typically covers bodily injuries to passengers and third parties and property damage to third parties. Ground Risk Hull Motion Insurance. The ship hull insurance policy covers marine risk which is a risk arising from navigation or linked to the sea.

Hull insurance typically covers all parts that would normally be affixed to the aircraft and the labor to repair the aircraft after incident. A hull means the body of the vessel and that is exactly what is covered by this insurance policy. This type of insurance is similar to GRH non-motion insurance except that it covers damages sustained while the plane is on the ground and in motion.

Liability covers your responsibility to the other driver or to their passengers for injury and property damage. Vessels insurance covers accidental loss or damage to the vessel anywhere in the agreed navigational limits set by the policy. It includes salvage costs and third party liability cover.

It covers your vehicle in the event of a theft or vandalism. It may also include portable equipment eg handheld radios and headsets if stated in the policy. Builders risk insurance for indemnification against.

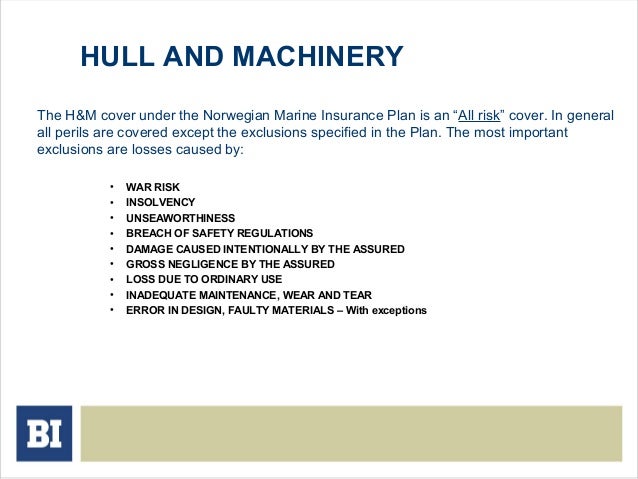

Marine Hull Hull Machinery The Coverage This policy covers the vessels hull and machinery during their operation within the specified trading limits. Hull coverage may also be written as a separate policy. Hull coverage may also be written as a separate policy.

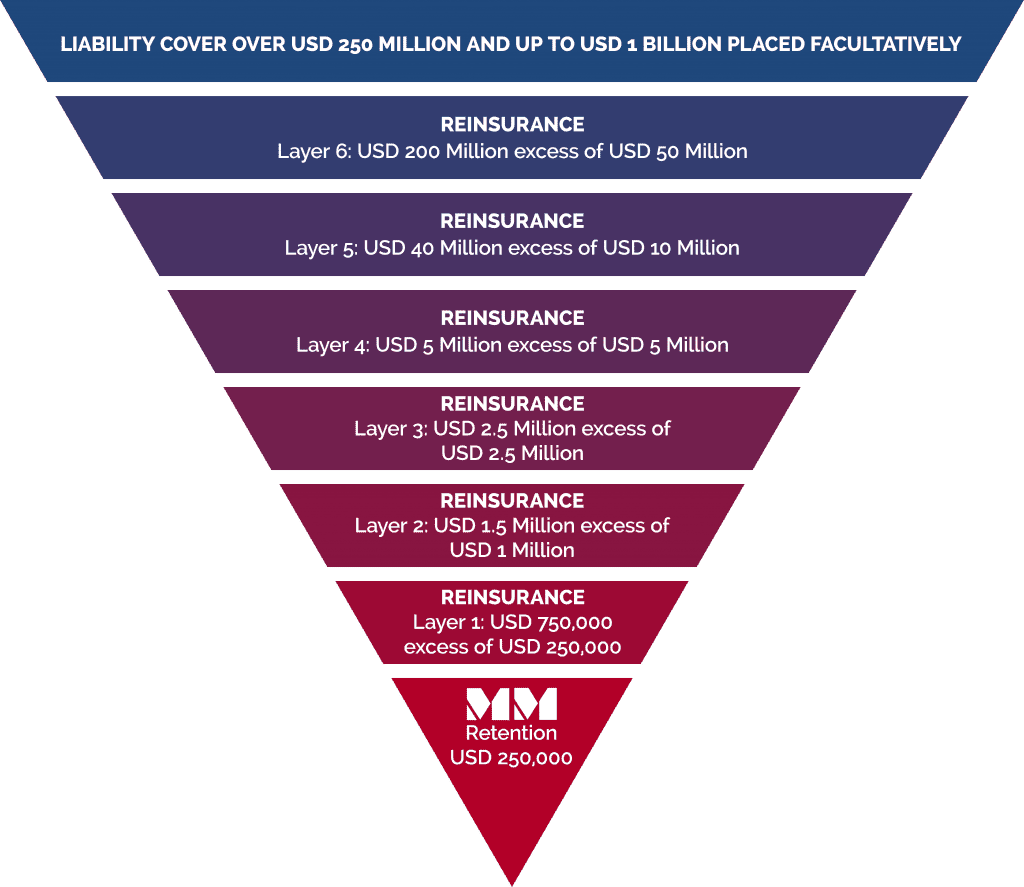

Protection against physical damage to hull and machinery. Full coverage insurance is a catch-all term used to describe a car insurance policy that includes liability collision and comprehensive coverage. These limits can go up to and over 250000 per person for bodily injury up to 500000 per accident and up to 100000 and over for property damage.

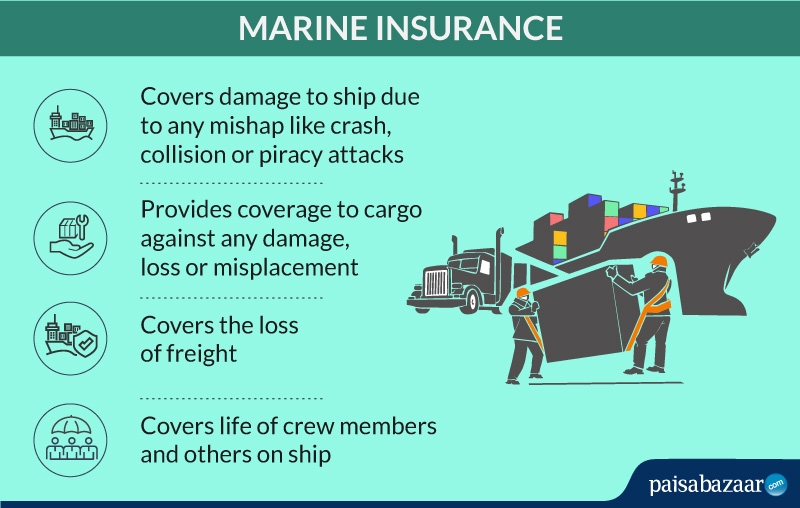

Marine hull insurance covers accidental loss or damage to boats used for commercial purposes. Security against war terrorism kidnapping and ransoms. Valuation and a survey of the vessel is usually required for this insurance and set at an agreed value.

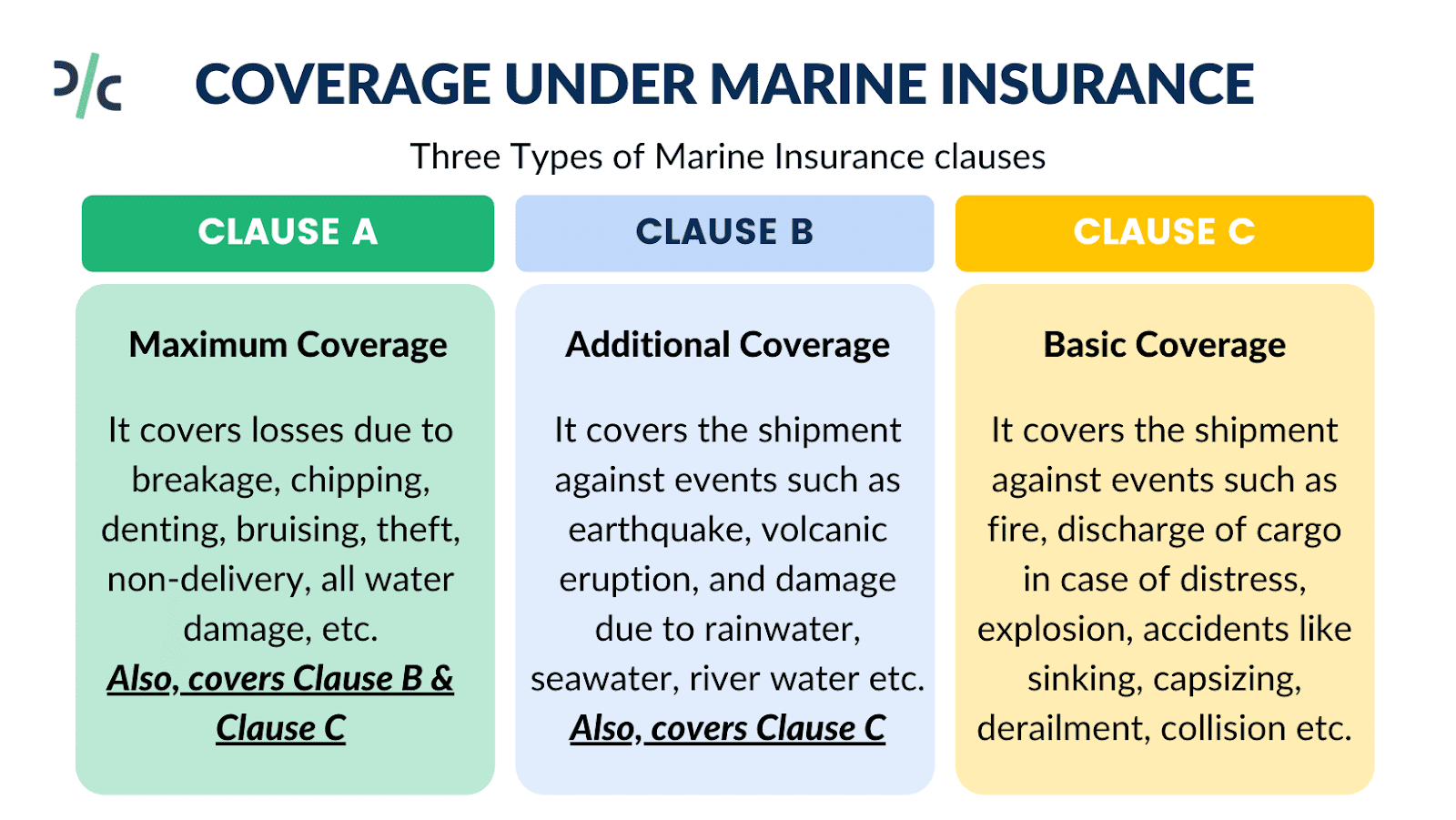

Marine hull insurance is an insurance policy specifically designed to provide coverage to water vehicles like a boat ship yacht fishing boat steamer etc. Coverage may apply on a named perils or an open perilsall risks basis. Whats not covered by aircraft hull insurance.

This means you have coverage protecting yourself and your property in addition to damages you may cause to someone else or their property in an at-fault accident. It can also help with losses resulting from flood hail and when you hit an animal. Theres no auto policy called full coverage that will cover any and all damage that might happen to or with your car.

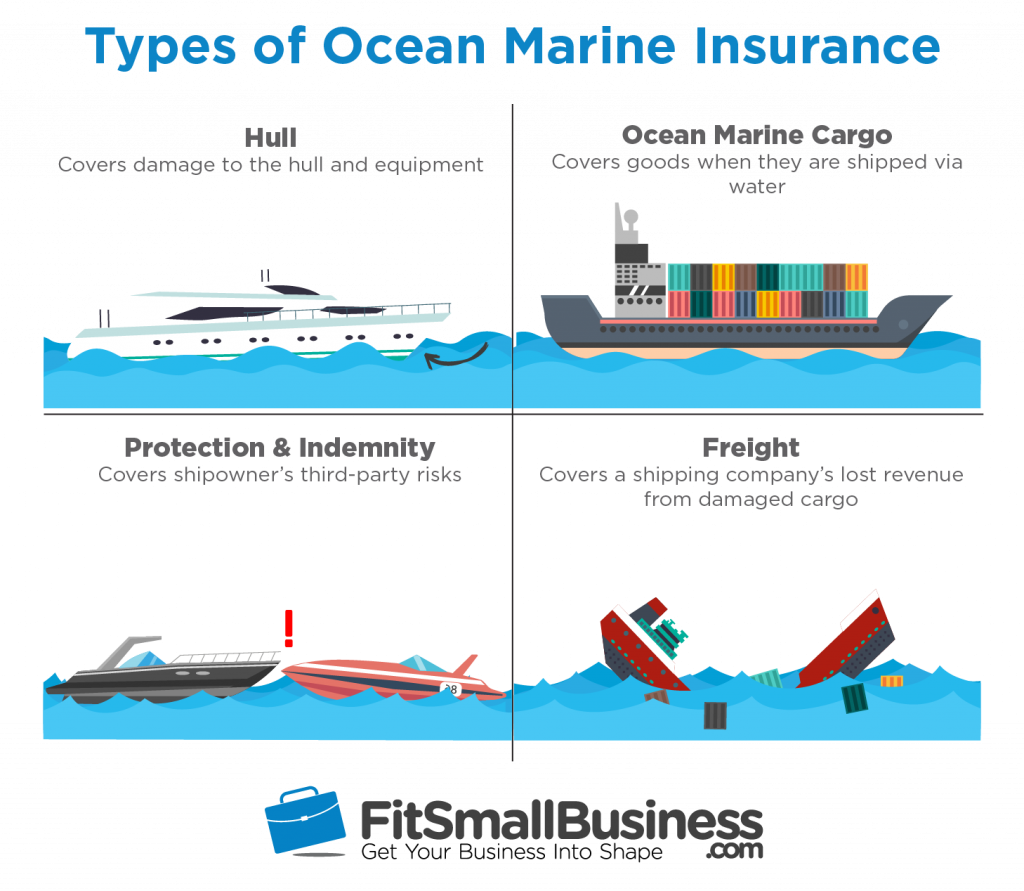

Coverage for any disbursements as well as increased value and excess liabilities risks. This type of coverage is usually mandated by law in many places. Types of Marine Insurance policies.

The insurance provides financial protection in case of any damage to the vessels body hull. Hull coverage is typically subdivided to address aircraft while in motion and while not in motion. Coverage may apply on a named perils or an open perilsall risks basis.

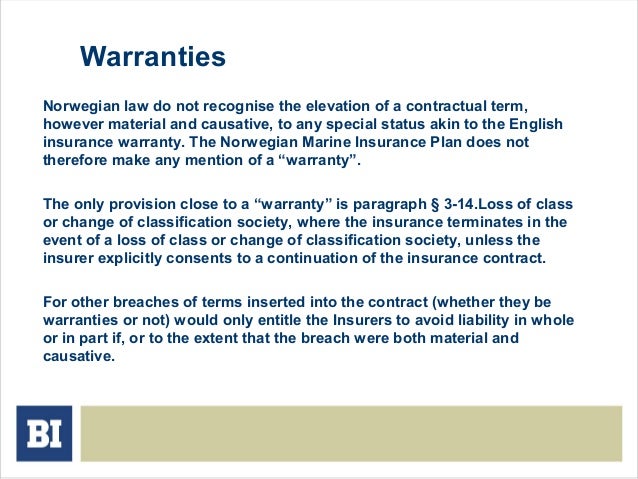

Marine cargo policy refers to the insurance of goods dispatched from the country of origin to the country of destination. Hull and P I policies frequently contain warranties. Hull and machinery underwriters produce insurance coverage for boats ships and other naval assets.

The policy covers Partial Loss and Total Loss of the vessel insured. 1 Be wary of any agent who claims that this is the case. Marine hull insurance is an insurance policy specifically designed to provide coverage to water vehicles like a boat ship yacht fishing boat steamer etc.

Hull coverage is usually subject to a deductible which varies depending on insurer the type of aircraft and its age. INSURANCE HULL ALL RISK AIRCRAFT INSURANCE POLICY Aircraft is unreported for sixty days after the Amount Insured as specified in Part 25 of the Schedule and subject to the consequent upon damage or forced landing up to 10 400 at any time shall have. Under federal law and the law of most states a breach of those warranties results in the voiding of coverage under the policy even if the breach of warranty is not related to the casualty for which coverage is sought.

It covers the transportation against damages and accidents. Where the Hull refers to the main body of the ship. All risks marine hull and machinery insurance policy 3 In the paragraph above legal costs shall mean only such costs as are incurred with Insurers prior agreement.

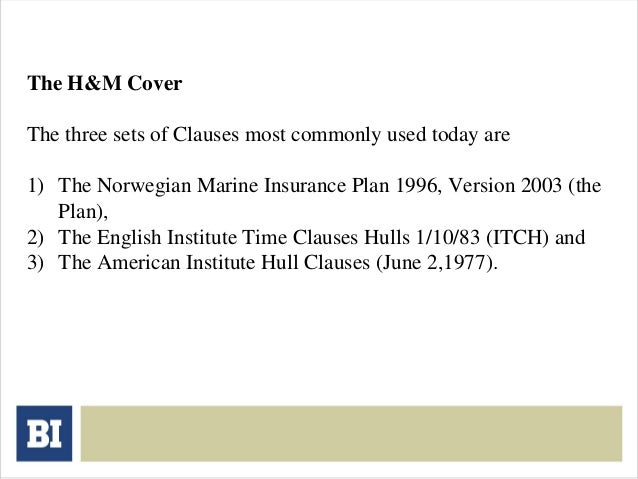

Only a few states require a causal connection between the breach of a policy warranty and a loss to void coverage. Hull insurance is an insurance policy especially designed for covering ship damage expenses. A Institute Time Clauses Hull.

Hull coverage is usually subject to a deductible which varies depending on insurer the type of aircraft and its age. LIABILITY INSURANCE FOR YOUR AIRCRAFT COVERAGE A - Bodily Injury and Property Damage Liability Insurance We will pay for bodily injury and property damage for which an insured is legally liable caused by an occurrence arising from the ownership maintenance or use of your aircraft. Aircraft arent covered under standard liability policies.

Comprehensive is coverage for damage to your vehicle. It also covers the dangers of the sea such as ship sinking stranding and maritime collision due to bad weather conditions. Additional coverages help you personalize your car insurance policy.

Hull Insurance covers the hull torso of the transportation vehicle. Hull insurance can be understood like a car insurance with a difference of being for a water faring vehicle instead of land. The indemnity including the legal costs payable by the Insurers per accident under this Article 113 shall not.

A b c d e INSURANCE FOR MEDICAL EXPENSES COVERAGE B - Medical Expenses Coverage. Aircraft liability and hull insurance protects firms that use planes and other aircraft for business purposes.

Ocean Marine Insurance Coverwallet

What Does Hull Coverage Insurance Cover

003 Marine Insurance Covers Hull

Essential Features Of A Marine Insurance Contract By Enterslice

Hull Insurance And General Average Advisory Excellence

Difference Between Marine Insurance And Hull Insurance With Table

What Does Hull Coverage Insurance Cover

003 Marine Insurance Covers Hull

What Does Hull Coverage Insurance Cover

003 Marine Insurance Covers Hull

Marine Insurance Meaning Types Benefits Coverage Drip Capital

003 Marine Insurance Covers Hull

Ocean Marine Insurance Coverage Cost Providers

What Is Hull Insurance Securenow

Marine Insurance In India Types Coverage Claim Exclusions

Marine Insurance Types Of Marine Insurance Policies In India

The Problem Of Identification Attribution Of Fault And Gard

What Does Hull Coverage Insurance Cover

Posting Komentar untuk "Hull Coverage Insurance Policy"