Will Life Insurance Cover Covid Deaths

In fact any death is a claimable event which includes those for Covid-19. The only way a life insurance policy wouldnt pay out for the coronavirus was if the policy specifically excluded paying for certain types of deaths.

Insurance Cartoons Randy Glasbergen Today S Cartoon Life Insurance Affordable Life Insurance Marriage Cartoon

Deaths from COVID-19 will be covered by life insurance policies just like those from other causes.

Will life insurance cover covid deaths. Know if your life insurance policy will cover COVID-19 death or not. A recent analysis published by the Kaiser Family Foundation shows that a large majority of US. We want to reassure you that none of our Woolworths Life Insurance policies has a specific exclusion for a pandemic such as COVID-19.

Note that unlike Life Insurance Accidental Death Insurance which typically only covers death resulting from an accidental bodily injury does not typically cover death resulting from a disease or illness such as COVID-19. There are a few exceptions according to representatives from. For those who have life insurance in almost all cases they are covered and insurance will likely pay out for deaths from COVID-19.

If you bought a policy at any point in the past even in the last year the life insurance company still has to pay out if you die from the coronavirus. It can be tricky to work out the latest details of coronavirus. A post including segments of Allianzs policy documents alongside claims vaccine side effects would be considered self-inflicted is false and fraudulent the insurance.

The natural death or death caused by health-related issues is covered by term life insurance plans. Deaths due to COVID-19 represented more than 12 of claims. A COVID-19 term insurance plan is essentially a traditional insurance plan that provides an additional financial cover against death due to COVID-19.

April numbers for 2021 arent in yet but given the upward trajectory of case numbers we could expect a. In general life insurance policies cover deaths from natural causes and accidents. If you have an active life insurance policy and you were to die of a pandemic illness such as COVID-19 your family would receive the death benefit even if you had.

If a person has a life cover and he or she dies because of COVID-19 then the dependents or nominees will get the death benefits in the form of the sum assured. Does life insurance cover you for coronavirus. Can a life insurance company change terms and conditions of an existing life insurance policy to avoid paying the death benefit if death is due to COVID-19.

In April 2020 Canadas life insurance claims jumped to more than 500 million compared to about 440 million in April 2019. This because COVID-19 is an illness and does not meet the definition of an accident. Does life insurance cover COVID-19.

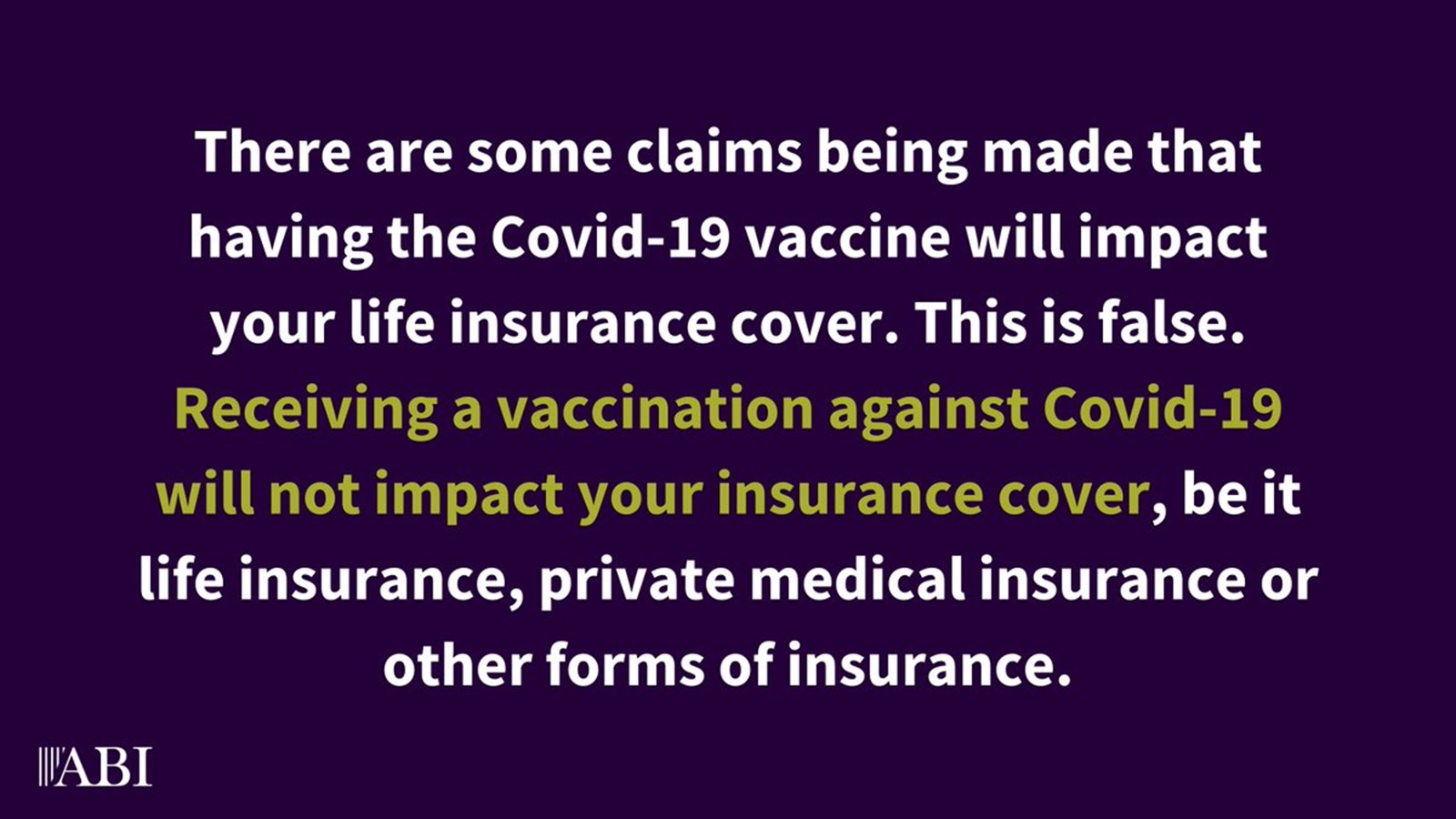

In fact life insurers cannot deny a death benefit because the deceased is vaccinated against COVID-19 according to the American Council of Life Insurers ACLI. The same rule applies to coronavirus. Receiving a COVID-19 vaccine will not void a persons life insurance policy according to Australias peak body for insurers.

Early in the pandemic insurance companies began waiving costs related to COVID-19 testing and treatment. However you need to consider the conditions of the life insurance policy add-ons whose benefits will be paid out only if. Heres what leading insurers say about coronavirus-linked exclusions for life cover.

As deaths mount so do life insurance claims. The nominees should be aware that the demise of the insured individual caused due to any health condition is generally covered under life insurance. For example theres the tweet that said just so you are aware many have died from the covid vaccine and if you have life insurance you cannot collect it because the vaccine is deemed.

If you lie on your application your insurer could refuse to pay out to your beneficiaries when you die. Will my life insurance policy cover COVID-19. Insurance Profits Soared During The Pandemic.

In case the policyholder dies due to any type of critical illness or medical condition the beneficiary of the policy will get the Sum Assured as the death benefit. In most cases people who have term or whole life insurance already will be covered which means insurance companies will pay out for deaths related to COVID-19. The last thing we want you to worry about is whether your Woolworths Life Insurance policy covers you for COVID-19.

If you need to buy life insurance it is still possible to obtain it from most insurers. Learn what steps you can take to purchase a life insurance plan that will secure your loved ones. Heres the good news.

And its not just life insurance that this applies to. The Association of British Insurers ABI has said any claims being made online about insurance being void for those getting the vaccine is false be it life insurance private medical insurance or other forms of. Generally term plans only provide death benefit due to illness if the insured succumbs to critical ailments such as.

Accidental death or Accidental TPD insurance under these policies there would be no cover provided for death or disablement resulting from COVID-19. Or that a life claim might be denied if premium payments were missed or a policyholder smoked or engaged in some other activity associated with high coronavirus mortality that theyd denied on their. This means if you are an existing customer you are covered regardless of whether or not you.

As long you have an active life insurance policy in good standing your beneficiary or beneficiaries will get a death benefit should you die of coronavirus-related complications. Medical misinformation on social media claims that life insurance companies will deny payouts to any deceased person who had taken the COVID-19 vaccine. Its possible some dread disease policies that cover specific conditions such as cancer might not be paid if COVID-19 rather than the disease insured against is deemed to be the cause of death.

Insurers are no longer covering COVID-19 treatment. Will life insurance payout for coronavirus pandemic.

Annuity Vs Life Insurance Similar Contracts Different Goals

How Does Whole Life Insurance Work Costs Types Faqs

What Is Term Life Insurance Money

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Download Insurance Concept Flat For Free In 2020 Car Care Insurance Concept

2021 Final Expense Life Insurance Guide Costs For Seniors

Do Life Insurance Policies Cover Suicidal Deaths

Download Family Under Umbrella For Free Umbrella Insurance Life Insurance Facts Life Insurance Quotes

Guide To Buying Life Insurance For Parents Elderly Burial

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Do Life Insurance Policies Cover Suicidal Deaths

How Does Life Insurance Work Forbes Advisor

The Rich Live Longer Everywhere For The Poor Geography Matters Live Long Geography Life And Death

How To Find Out If Someone Has Life Insurance

Posting Komentar untuk "Will Life Insurance Cover Covid Deaths"