Auto Insurance Coverage A B C D

The Insurance Corporation of British Columbia ICBC a government-owned monopoly insurer provides mandatory auto insurance. Medical payments coverage med pay pays medical expenses resulting from an automobile accident up to a specified dollar limit.

Blanket Insurance Near You Match With An Agent Trusted Choice

Has a government-run auto insurance market.

Auto insurance coverage a b c d. Coverage B Other Structures. Coverage C Personal Property. British Columbia Auto Insurance.

Detachable building items including screens awnings storm doors and windows and window air conditioners. Bodily injury liability personal injury protection property damage liability collision comprehensive and uninsuredunderinsured motorist. Part EDuties after an accident or loss.

100000 would be paid to the people in your automobile and the 300000 to passengers in the other car. J has a personal auto policy with Liability limits of 5010025 UMUIM limits of 50100 a Medical Payment limit of 5000 and Comprehensive and Collision deductibles of 500. Add them up and youve got the price of your auto insurance policy.

Basic Auto Insurance Coverage. And Insurancecagov Get All. A DO policy takes care of this financial trouble.

Part B coverage refers to the medical payments coverage frequently offered by insurance companies to the buyers of Personal Auto policies PAP. Section A Third Party Liability which protects the insured Newfoundland and Labrador driver andor the registered vehicle owner in the event they cause injury death or property damage to a third-party resulting from negligence. Outdoor structures other than buildings which are not permanent components or fixtures of a building.

These policies offer coverage for liability medical payments damage to the vehicle and damage from uninsuredunderinsured motorists. Search Faster Better Smarter at ZapMeta Now. 4 hours ago The homeowners policy contains two sections.

Your auto liability insurance shows bodily injury limits of 100000300000. Some types of coverage are required by state law depending on where you live. That means drivers have to purchase mandatory auto insurance coverage from a Crown corporation known as the Insurance Corporation of British Columbia ICBC.

J also sustains 1000 in injuries. Coverage A Dwelling. It covers the legal costs and the costs incurred in compensating third parties.

Carpeting curtains and drapes all whether or not permanently installed. Section I provides property coverages A B C and D while Section II provides liability coverages E and FA brief description of the individual coverages follows. Consider each one and ask yourself how much you need.

If available some optional coverages and benefits might be offered at an additional charge. Lets understand what these three parts cover. Note that each type of coverage is priced separately so there is variability in.

The province has a tort-based system with no-fault accident benefits. 200000 Third-Party Liability If you are involved in an at-fault accident this will protect you from any claims made against you for material damage or bodily injury to the other party. Search Faster Better Smarter at ZapMeta Now.

100000 is the limit per individual with 300000 divided equally between the remaining passengers. Extended Coverage An endorsement added to an insurance policy or a clause included in the policy to provide additional coverage for risks other than. Part A explains the liability coverage Part B explains the medical payments.

Insurance terms and definitions from B C Insurance. Essentially it guarantees that all medical or funeral expenses of the insured and the occupants of the insureds vehicle will be covered if they sustain bodily injuries or die as a result of a car accident within three years of the accident. The scope is divided into three parts Side A Side B and Side C covers in a DO policy.

Part DCoverage for damage to your auto. Each type of coverage has its own premium. Part CUninsured motorists coverage.

Ad Find Auto Insurance Coverage. Each of the first four parts has its own insuring agreement exclusions and other insurance provisions but most conditions are in parts E and F. The personal auto policy PAP is a standardized design for auto insurance.

Coverages and benefits listed below may not be available in your state. Part B--medical payments coverage. Since 1973 drivers have had very little choice on car insurance quotes in BC.

Mandatory Auto Insurance Includes. Additional coverage can be purchased from private insurers or from ICBC. Think of your auto insurance policy as six separate policies.

Js vehicle slides on ice and hits a guardrail causing 9500 in damage to the vehicle and 11000 damage to the guardrail. Ad Find Auto Insurance Coverage. While different states mandate different types of insurance and there are several additional options such as gap insurance available most basic auto policies consist of.

Motorists must carry Basic Autoplan insurance that includes the following five benefits. Contact B C Insurance today to learn more. A type of auto insurance coverage that typically provides payment up to specified coverage limits for the insured covered family members and covered passengers for their reasonable and necessary medical treatment for bodily injury or funeral expenses caused by a covered car accident.

A personal auto policy has a set layout of six sections. The policy provides comprehensive scope of coverage. For example most auto insurance policies exclude coverage for normal wear and tear drag racing and intentional acts.

The purpose of med pay is to provide payment for immediate medical treatment for passengers of. Section D Uninsured Automobile Coverage Which provides protection for any injuries you or your passengers sustain if an.

7 Types Of Car Insurance Coverage Abc Of Money

Limit Of Liability What You Should Know Insurance Dictionary By Lemonade

42 If You Buy A New Car Your Current Insurance Will Chegg Com

Types Of Auto Insurance Coverage

Best Car Insurance Companies In Connecticut Coverage Com

Vehicle Information Chapter 9 Vehicle Information Before You

Vehicle Information Chapter 9 Vehicle Information Before You

Coverage Parts Of An Auto Insurance Policy Safeguard Insurance Las Vegas Nv

Chapter 10 Auto Insurance Copyright C 2014 Pearson Education Inc All Rights Reserved 22 2 Agenda O Personal Auto Policy Part A Liability Coverage Ppt Download

Chapter 10 Auto Insurance Copyright C 2014 Pearson Education Inc All Rights Reserved 22 2 Agenda O Personal Auto Policy Part A Liability Coverage Ppt Download

Vehicle Information Chapter 9 Vehicle Information Before You

What Does Homeowners Insurance Cover

Analysis Of Personal Automobile Insurance

7 Types Of Car Insurance Coverage Abc Of Money

Vehicle Information Chapter 9 Vehicle Information Before You

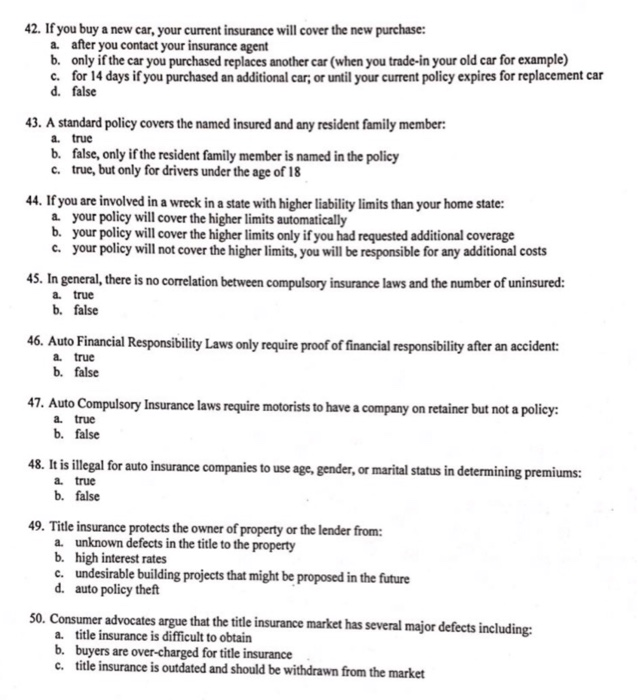

Posting Komentar untuk "Auto Insurance Coverage A B C D"