Average Insurance Coverage Singapore

Only 1390 of all claims are 100000 and above. They offer coverage of up to S5000000 for damage to third-party property unlimited coverage for death or injury to third party legal representation and defence coverage of up to S3000.

4 Types Of Insurance All Working Singaporean Should Consider Singlife

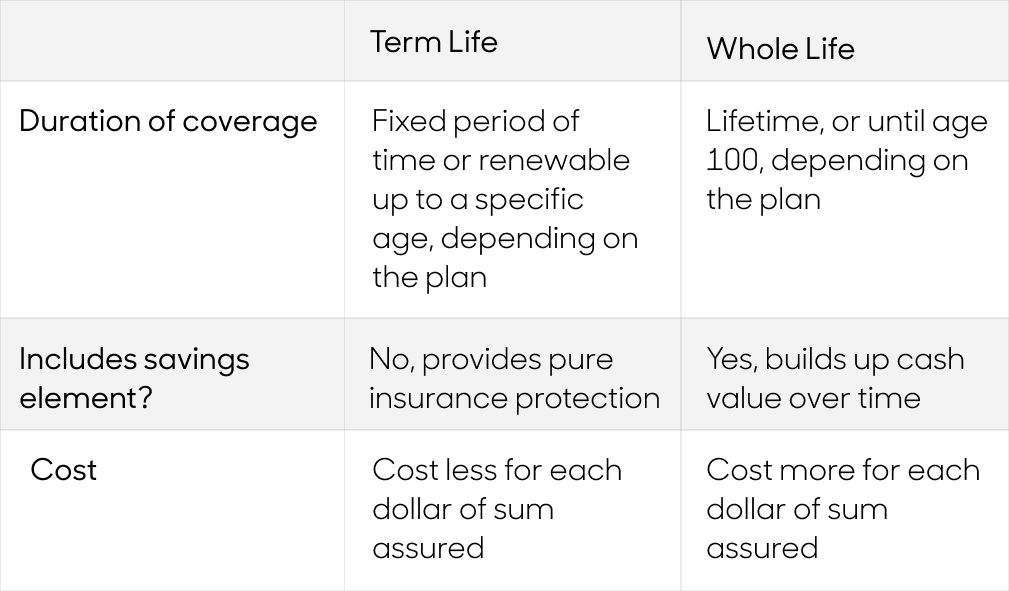

This is a purely coverage focused product where all your monthlyyearly premiums go into coverage so at the end of 65 years old you are no longer covered and there is no cash component to this.

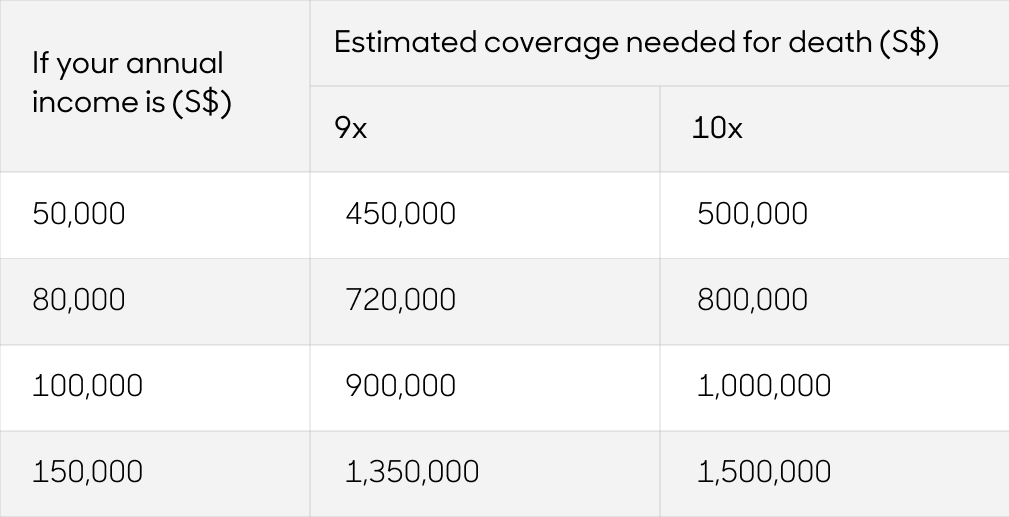

Average insurance coverage singapore. 10X of annual income of 500k whichever higher. Insurance salaries in Singapore range from 3140 SGD per month minimum average salary to 16300 SGD per month maximum average salary actual maximum is higher. On average expect to pay around S1000 to S1500 per annum for a policy that covers medical expenses of.

3 to 5x of yearly expenses. Although the needs and the actual insurance coverage will have to base on individual financial situation and suitability of the individual product. 5 to 7x of yearly expenses.

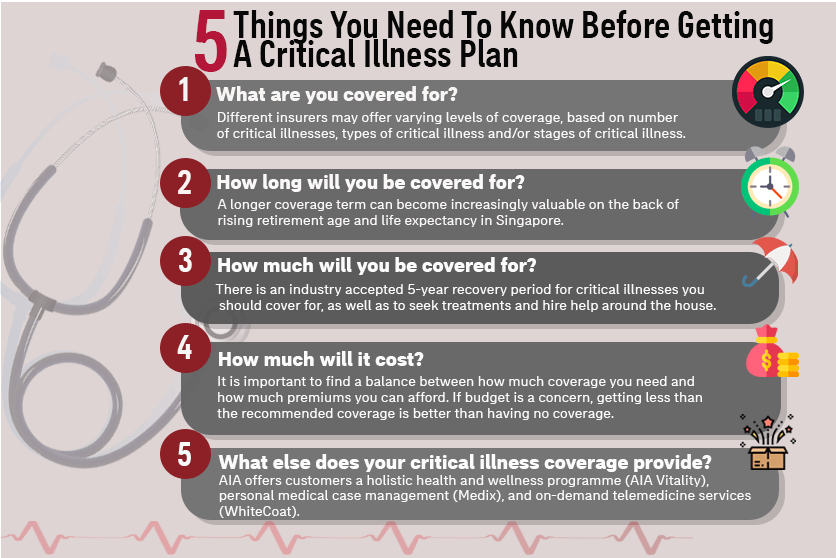

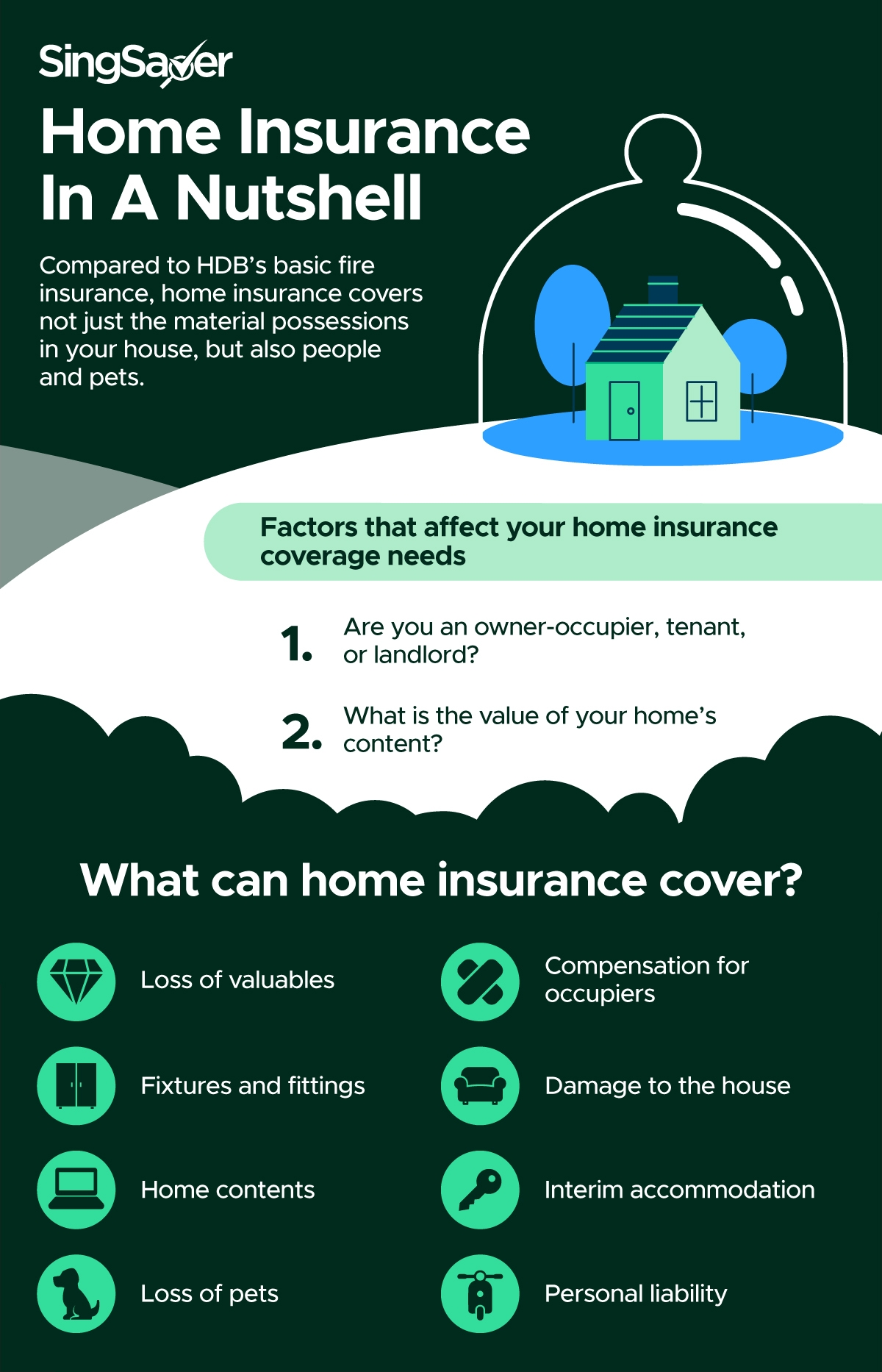

Whenever possible seek to have the following insurance coverage for Critical Illness and Early Critical Illness. Even when you choose to maximize your contents and renovation coverage FWD Home Insurances premiums still cost 46-51 below the industry average. Ad Health Cover Wherever You Are.

Next on the list of the 10 best car insurance in Singapore is Budget Direct which offers some of the cheapest policies on the market. The average car insurance in Singapore issued by many well-known insurance companies such as NTUC Income Aviva Ltd AXA Singapore AIA Singapore AIG Singapore MSIG Singapore and much more usually comes in 3 different types of coverage. Theres even an NCD protector thats available across all three plans if you want as an optional cover at an additional premium for drivers with an NCD of 30 and above.

If youre here you already know the importance of insurance but youre just thinking how much is enough. In that year the average life insurance coverage per policy was around 472 thousand Singapore dollars for males aged between 40 to 44 years. Is the rules of thumb when we speak about insurance needs of an average Singapore citizenThis is with reference to LIA report done in 2012.

This question sounds simple but its difficult to answer. How much insurance coverage does a Singaporean need. What is the average cost of health insurance for Expats.

Early Critical Illness coverage. In that year the average number of life insurance policies for females aged between 45 and 49 years in Singapore was 375. Unfortunately there is no definite answer.

Median Salary The median salary is 8980 SGD per month which means that half 50 of people working in Insurance are earning less than 8980 SGD while the other half are earning more than 8980 SGD. This is something you have to accept. With its unbeatable premiums of almost 55 below average regardless of gender and NCD Budget Direct would be a great fit for drivers whose priority is to minimize their costs.

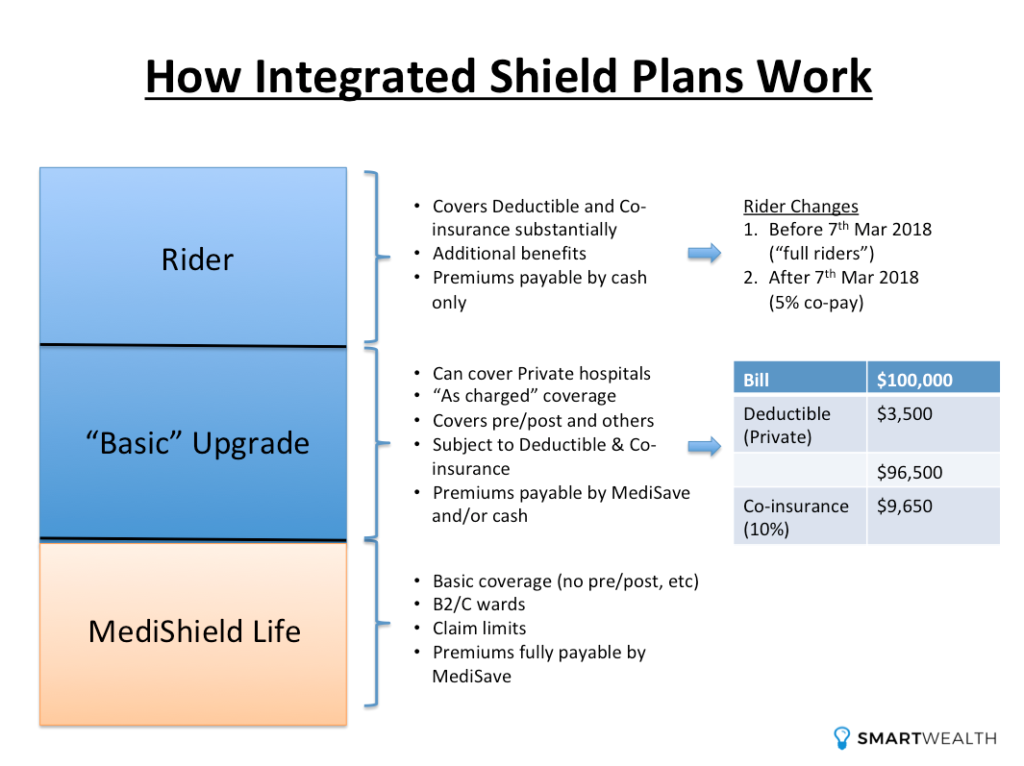

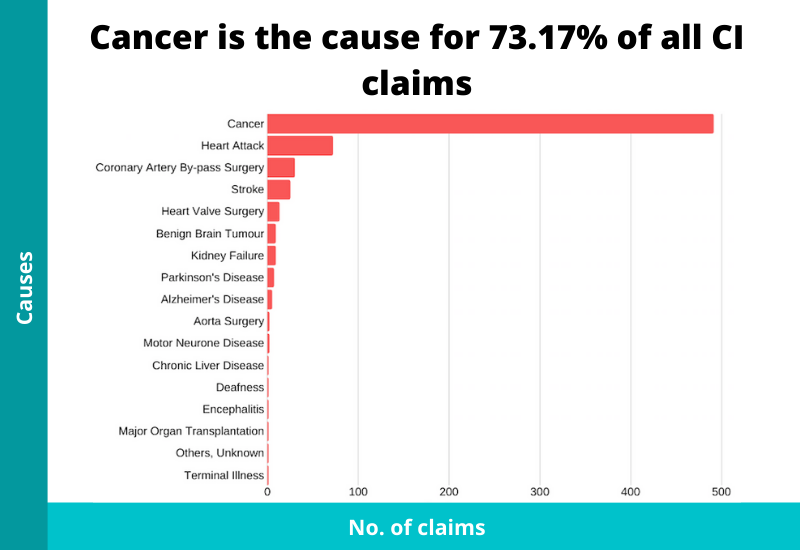

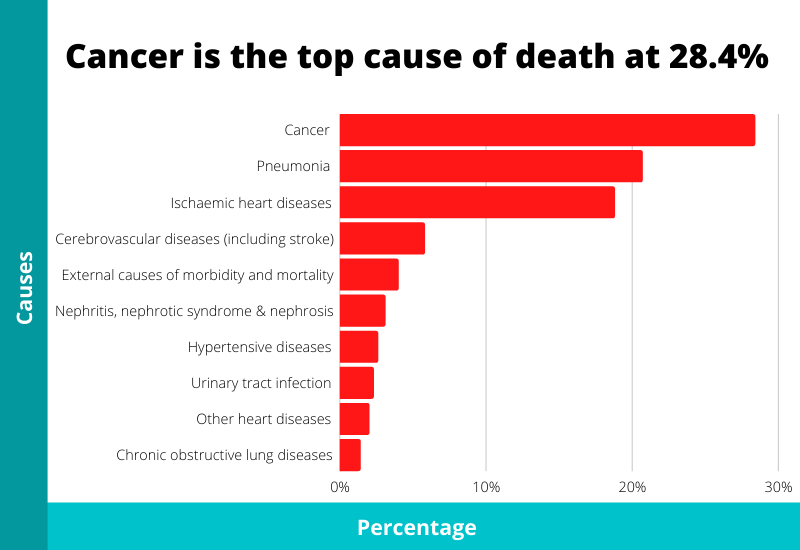

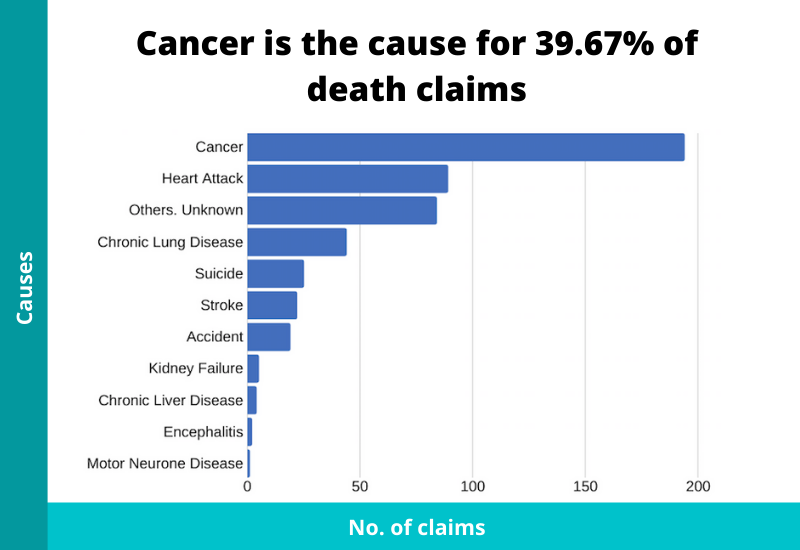

Out of all life insurance claims death total and permanent disability TPD and critical illness CI made up 4751 281 and 4968 respectively. No right or wrong answer. Generally the average cost of an Integrated Shield Plan covering a B1 ward for non-smoking.

Your life coverage also known as the payout in the event of death covers 70 of your current annual to the average life expectancy of a male or female in Singapore. Your actual death coverage needs may be higher or low depending on the number of dependants future financial commitment and inflation. Whats the average cost of health insurance.

Offering competitive prices and generous coverage FWD Home Insurance is one of the highest value-for-money plans on the market for the average homeowner especially for HDB or Condominiums. Ad Health Cover Wherever You Are. Here are the average claim payouts.

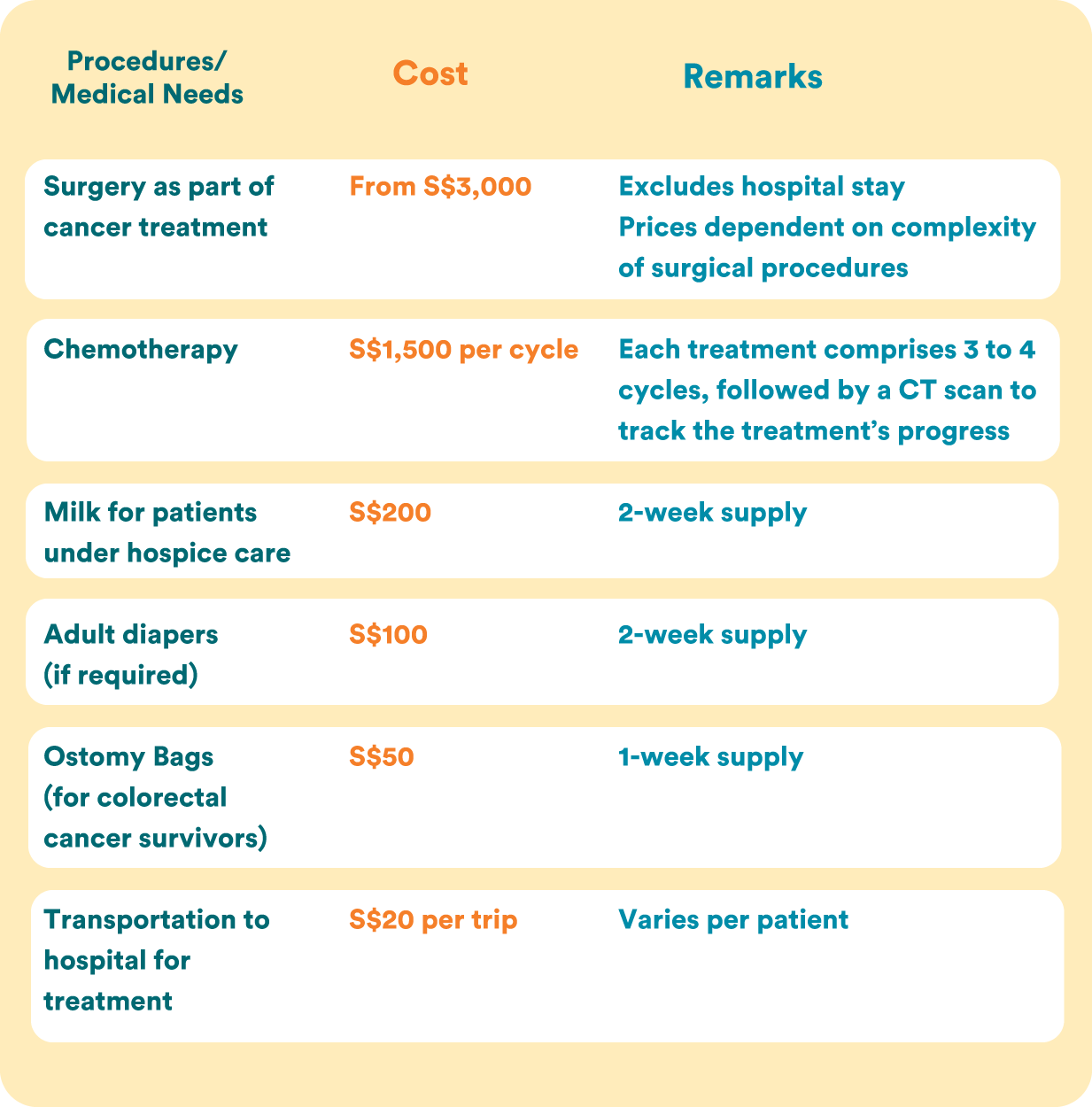

The average Singaporean spends eight out of 82 years in ill health. Make your expenses and financial commitment the least of your worries. Average Cost of Health Insurance in Singapore In one of the most expensive cities in the world an important question is always how much is health insurance.

Most critical illness insurance policies provide coverage for at least 37 illnesses including cancer heart attack and stroke. How much death coverage do you need. How Much Life Insurance Coverage Do You Need in Singapore.

Life insurance ESSENTIAL Term Life. On average a 45-year-old expat living and working in Singapore will pay 3200 SGD 2300 USD per year for a health insurance plan.

Best Cheap Insurance Plans For Covid 19 Novel Coronavirus Coverage Valuechampion Singapore

Integrated Shield Plans In Singapore Ultimate Guide For 2021

Hdb Fire Insurance Vs Home Insurance What S The Difference Propertyguru Singapore

Early Critical Illness Ci Insurance In Singapore Guide For 2021

Car Running Costs Singapore 2021

Best Home Insurance Of October 2021 Singsaver

Cancer Treatment Costs In Singapore Is Critical Illness Coverage Enough Fwd Singapore

Average Cost And Benefits Of Personal Accident Insurance 2021 Valuechampion Singapore

Best Cheap Insurance Plans For Covid 19 Novel Coronavirus Coverage Valuechampion Singapore

Insurance Coverage Cost Financing Parkway East Hospital Singapore

Why Are Cars So Expensive In Singapore

Now Health Worldcare Health Insurance Is It Worth Its Price Health Insurance Review Valuechampion Singapore

Seven Thoughts You Have As Insurance Costs Per Car Approaches Insurance Costs Per Car Car Insurance Car Insurance Rates Cheap Car Insurance

The Average Hospital Bill Size In Singapore Can You Afford It

7 Worrying Critical Illness Statistics In Singapore 2021

Over 80 Of Critical Illness Patients And Their Caregivers Regret Not Buying More Insurance Coverage Great Eastern Consumer Survey

5 Things To Know Before Buying A Critical Illness Plan Life Matters

Early Critical Illness Ci Insurance In Singapore Guide For 2021

4 Types Of Insurance All Working Singaporean Should Consider Singlife

Posting Komentar untuk "Average Insurance Coverage Singapore"