Homeowners Insurance Coverage Percentage

Is 1249 a year according to the National Association of Insurance Commissioners. The average cost of homeowners insurance in the US.

How Much Does Homeowners Insurance Cost Lemonade Insurance

At this point the homeowner is responsible for any amount of money required to complete the project.

Homeowners insurance coverage percentage. Most homeowners insurance policies provide coverage for your belongings at about 50 to 70 percent of the insurance on your dwelling. Your insurance premiums the amount you pay for coverage are. This depends on the.

Most homeowners policies cover. Standard homeowners insurance policies provide coverage for some natural disasters that cause extreme damage and loss of life. The average homeowners insurance cost in the United States is 1312 per year or about 109 per month for a policy with 250000 in dwelling coverage according to 2021 data from Quadrant.

If as noted in the example the workers were indeed 90 percent finished and the remaining cost was 55555 then the homeowner would have to pay the construction company that amount. Conduct a home inventory of your personal possessions. You can increase that amount by purchasing additional coverage through an ordinance or law endorsement.

60 Percentage of homes in the US. Choosing the right homeowners insurance company can be confusing. Garages storage sheds etc.

So if your home is insured for 308000 that would be 30800 in ordinance or law coverage. To learn if you have enough coverage. The coverage amounts set forth in the chart immediately below expressed as a percentage of the amount your dwelling is insured for is the amount you are generally provided by most insurers under a Special Form Policy discussed above.

Generally homeowners insurance companies set the limit for your personal property insurance at between 50 and 75 of that for your dwelling coverage. If you have an older home it may make sense to increase your ordinance or law coverage to 20 percent in case your systems are outdated or your building codes arent up to date. Severe thunderstorms and tornadoes.

Personal property coverage is about 50 percent of your dwelling coverage amount. Standard home insurance includes a limited amount usually 10000 or 5 of your homes coverage amount of building ordinance coverage. The limits of your coverage for the following are typically a set percentage of your dwelling coverage limit as shown below.

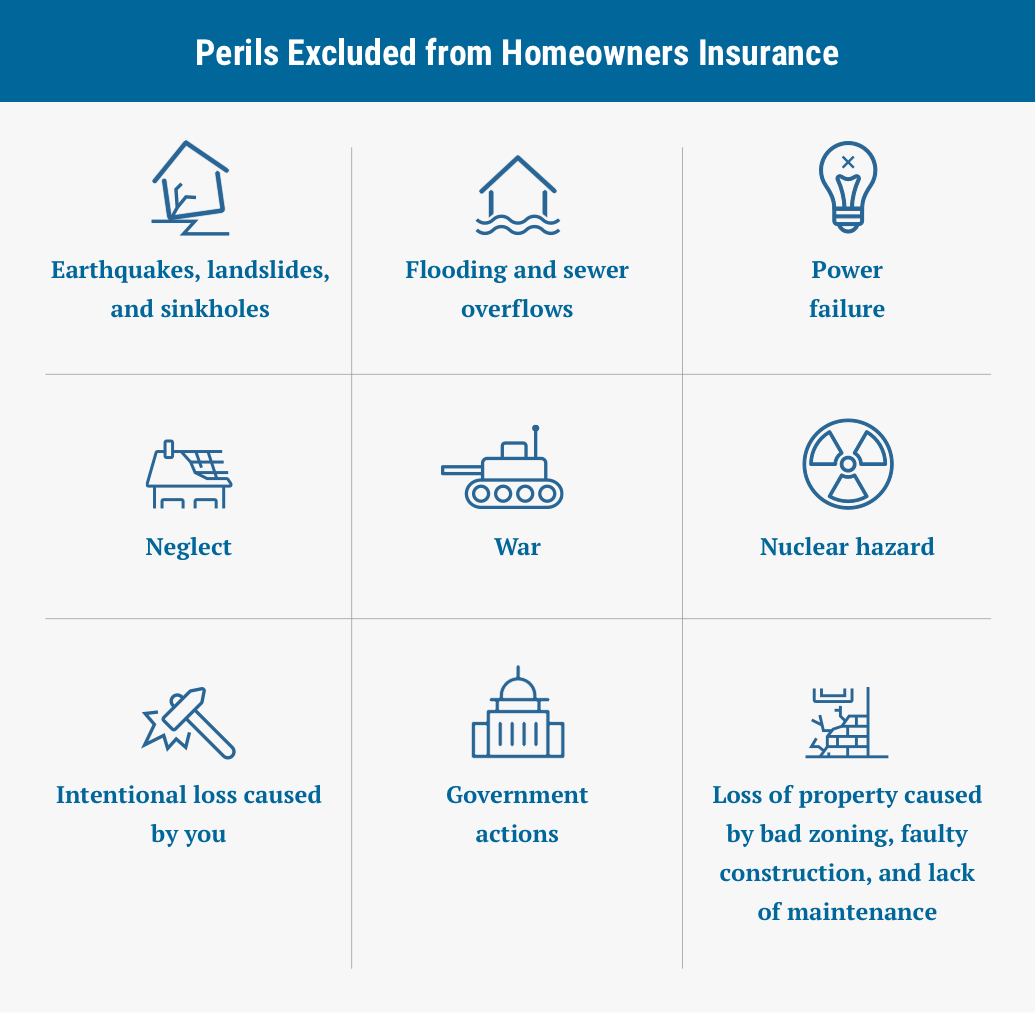

Flood and earthquake coverage are not included in a standard policy and must bought separately. This is usually set at 10 percent of your dwelling coverage. If youre not careful underinsuring your home can leave you paying a large bill.

In the United States some acts of God. According to the Insurance Information Institute most insurance companies will provide coverage for 50 to 70 of the amount of insurance you have on the structure of your home. But its also possible to get a policy thats 70 percent of your dwelling coverage or more.

Weve done the research and found the Best Homeowners Insurance Companies of 2021. Other structures 10 personal property 50 you choose between replacement value or actual cash value. 44 Percentage of homeowners insurance policyholders who comparison shop when their policy is up for renewal 1249 The average annual cost of a standard HO-3 homeowners insurance policy as of 2018.

Conducting a home inventory can help you determine if you want to increase this policy limit. With a market share of around 17 percent of the industry in 2017. Determine how much insurance you need for your possessions.

What is the 80 Percent Rule in Homeowners Insurance. 1 But insurance companies consider multiple factors when setting your rates including. Most homeowners insurance policies start with personal property coverage equaling between 50 and 70 percent of your dwelling coverage limit.

Average homeowners insurance premiums rose by approximately 31 in 2018 following a 16 increase in 2017 according to a January 2021 study by the National Association of Insurance. However that standard amount may or may not be enough. So if for example your dwelling coverage limit is 200000 your personal property coverage limit would likely be between 100000 and 150000 depending on the company and policy you choose.

State Farm is the leading company that provides homeowner insurance in the US. If your house burns down homeowners insurance typically covers the entire claim as long as the homeowner has dwelling coverage for more than 80 of the houses replacement value. Stats about homeowners insurance coverage.

How your home insurance rates are calculated.

How Much Is Homeowners Insurance Average Insurance Cost In 2021 Policygenius

Average Cost Of Condo Insurance 2021 Valuepenguin

Raise Your Deductible To Save 16 On Home Insurance

6 Best Homeowners Insurance Companies Of October 2021 Money

How Much Homeowners Insurance Coverage Should You Have Honolulu Financial Partners

Renters And Homeowners Insurance When The Unexpected Happens St Louis Fed

What Is Homeowners Insurance Lemonade Insurance

What Is Isn T Covered Under Unendorsed Homeowners Policy

6 Best Homeowners Insurance Companies Of October 2021 Money

The Best Homeowners Insurance In Arizona Valuepenguin

What Is Homeowners Insurance Lemonade Insurance

Us Homeowner S Insurance Market 2021 26 Industry Share Size Growth Mordor Intelligence

Understanding Your Home Insurance Declarations Page Policygenius

Inside Condo Insurance Forbes Advisor

7 Homeowners Policy Diagram Quizlet

Allstate Insurance Rates Consumer Ratings Discounts

Us Homeowner S Insurance Market 2021 26 Industry Share Size Growth Mordor Intelligence

What Is A Homeowners Insurance Deductible Valuepenguin

Posting Komentar untuk "Homeowners Insurance Coverage Percentage"