Life Insurance Decreasing Cover Meaning

With our Life Insurance Plan with increasing cover the level of cover increases annually in line with the Consumer Price Index CPI a recognised measure. These plans are generally more affordable than other types of term life insurance making them a smart choice if you just need insurance to cover a temporary need or plan to leave little to no debt for your family to.

Pin On Best Of Madambudget Blog

What is decreasing term life insurance.

Life insurance decreasing cover meaning. Decreasing-term life insurance is usually taken out to ensure a specific debt is covered usually a mortgage. If you purchase a 20-year plan with a 300000 payout and a reduction rate of 5 your payout would decrease by. Meaning the policy is valid for a specified amount of time.

Decreasing term life insurance is similar to level term with one significant difference the amount of insurance reduces over time roughly in line with the way a repayment mortgage decreases. Decreasing-term life insurance ensures that if you die your loved ones wont have to face the. Other features of the plan are similar to normal term insurance plans and are as follows.

If youre steadily paying off your mortgage in the event of your death your dependants would need less money to cover what remains of it as time goes on. Decreasing term insurance is renewable term life insurance with coverage decreasing over the life of the policy at a predetermined rate. This type of cover also only remains in place for a specific amount of time.

A bank will normally mandate that such cover is purchased before providing. Decreasing term life insurance sometimes known as mortgage life insurance means your cash sum decreases roughly in with the way a repayment mortgage decreases though the premiums stay the same unless changes are made to the policy. As this debt decreases over time so will the amount of insurance.

Who is Decreasing Cover Life Insurance for. Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. Designed to help protect a repayment mortgage or similar debt decreasing-term life insurance can pay out a cash sum in the event of your death or if youre diagnosed with a terminal illness.

You can choose the original Sum Assured under the plan which. There is another form of term life cover know as level. 8 hours ago Term life plans typically come in lengths of 10 to 30 years.

A decreasing term life insurance policy is the most common and cost-effective way of covering a repayment mortgage as the amount of cover can reduce over time in line with your mortgage balance. Decreasing term life insurance policies are available for terms lasting from one to 30 years. Decreasing Term life insurance is a policy where your cover amount goes down or decreases over the policy term that you have chosen.

Decreasing term life insurance is a type of life insurance policy that pays out less over time. Its usually purchased to help clear a specific debt such as a repayment mortgage. Which in turn lowers the.

It could pay out a cash sum if you die or youre diagnosed with a terminal illness with a life expectancy of less than 12 months during the length of your policy. You pay the same amount each month or year but your death benefit grows smaller. With this type of insurance the amount of cover reduces roughly in line with.

Decreasing Term Life Insurance Policies Fidelity Life. Decreasing term life insurance is a type of term life insurance whose death benefit decreases at a set rate as the policy maturesDecreasing term life insurance is life insurance coverage in which the face amount of a term life insurance policy declines by a certain specified amount over a specific number of yearsDecreasing term life insurance is one of the most common types of life insurance policy you. How does decreasing term life insurance work.

Decreasing term life insurance is a type of term life insurance that offers a death benefit that shrinks over the duration of the policy typically five to 30 years. The logic is simple if at the time of purchase you needed a certain amount of death benefit to cover expenses and debts the total benefit needed should be lower over time. Usually people buy a decreasing term life policy that lasts only for the amount of years that they need to cover a specific debta home mortgage car financing or student loans for example.

A decreasing term insurance plan is a term plan where the Sum Assured decreases every year by a fixed percentage. If you have a life insurance policy with increasing cover the level of cover and your monthly payments may increase over time to help protect your cover amount from the effects of inflation. Your premiums stay the same.

Decreasing term life cover is designed to help your loved ones pay off your financial commitments such as a repayment mortgage loans or credit card balances if you pass away during the term of the policy. Its often used to cover the balance of a repayment mortgage because the total balance of the mortgage decreases over time and will be paid off in full at the end of the term. Most providers cap their decreasing term life insurance cover between 6 and 8 meaning that if your mortgage has an interest rate higher than this then your insurance may not clear your total debt.

Premiums are usually constant throughout the contract and. Our life insurance with decreasing cover provides a level of cover that decreases over time broadly in line with a long-term loan or repayment mortgage. The definition of decreasing term life insurance is a life insurance policy that lasts for a certain amount of time has a level premium and a decreasing death benefit.

When taking out decreasing life insurance you will be covered for a fixed period or term. Term life insurance plans keep you covered financially for a set period of time. What is decreasing term life insurance.

This means your beneficiaries would receive enough to pay off the mortgage however there may not be any money left over. What is decreasing-term life insurance for. Our Decreasing Life Insurance is a type of insurance thats designed to help protect a repayment mortgage.

Typically purchasing a Mortgage Protection insurance plan will be one of the requirements of obtaining a mortgage in Hong Kong. Each year your decreasing term coverage will drop by a certain amount or percentage of the original payout. This cover type is designed to help your loved ones pay off a repayment mortgage if you pass away during the policy term.

As such a Decreasing Life Insurance plan which offers a death benefit in line with the decreasing amount of the mortgage owed is often referred to as Mortgage Protection Insurance. The way it works makes it particularly suitable for protecting a repayment mortgage or indeed any other loan that youre repaying over time. With a decreasing term life insurance policy the death benefit for the plan decreases over time.

For anyone buying a property using a repayment mortgage Decreasing Cover can be used to help cover the mortgage should the worse happen. Decreasing term life insurance is a form of term life cover.

Decreasing Term Life Insurance Comparethemarket Com

What Is Insurable Interest Definitions Permanent Life Insurance Universal Life Insurance

5 Different Types Of Life Insurance Policies In India

What Is A Life Insurance Policy Lapse Policygenius

/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Life Insurance Guide To Policies And Companies

What Is Term Life Insurance Money

How Do You Qualify To Sell Your Life Insurance Policy Life Insurance Policy Term Life Life Insurance Companies

Pin By Finance Blog On Finance Hub Protection Life Insurance Life Insurance

Decreasing Term Life Insurance Comparethemarket Com

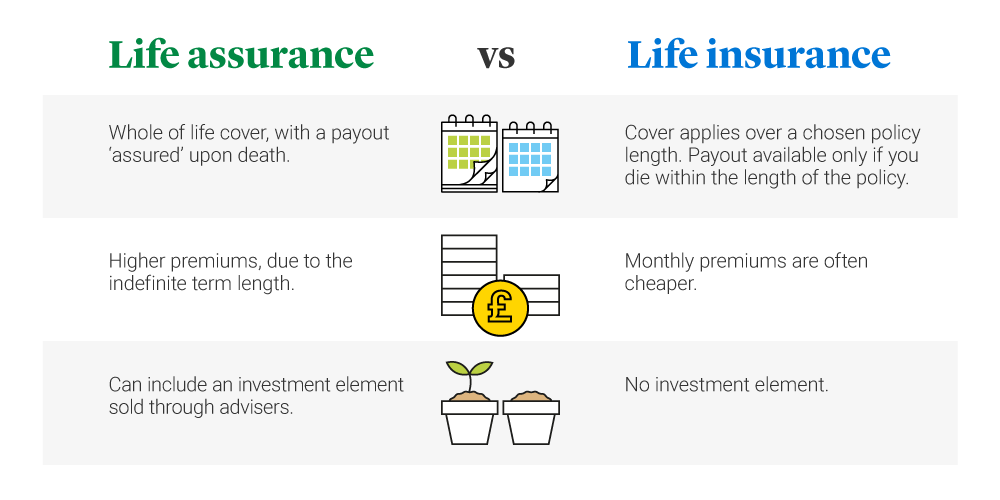

Life Assurance Vs Life Insurance Legal General

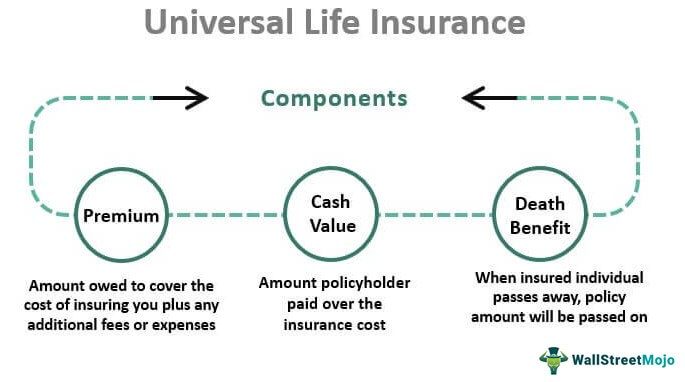

Universal Life Insurance Definition Explanation Pros Cons

How Does Life Insurance Work Forbes Advisor

Life Insurance Explained Types Of Life Insurance Alllife

Life Insurance Policy For Parents Top 5 Considerations Life Insurance Policy Life Insurance Quotes Life Insurance Broker

Life Insurance Gender Gap Advantage Insurance Solutions In 2021 Gender Gap Life Insurance Insurance

Annuity Vs Life Insurance Similar Contracts Different Goals

Guide To Universal Life Insurance Nextadvisor With Time

Holiday Home Business For Sale Cornwall Home Based Business Insurance Definition Motivacion Positivo Frases

Posting Komentar untuk "Life Insurance Decreasing Cover Meaning"