Homeowners Insurance Coverage Meaning

Here is what you should know about homeowners insurance. Elevation and it was at 6 ft.

Types Of Homeowners Insurance Hippo

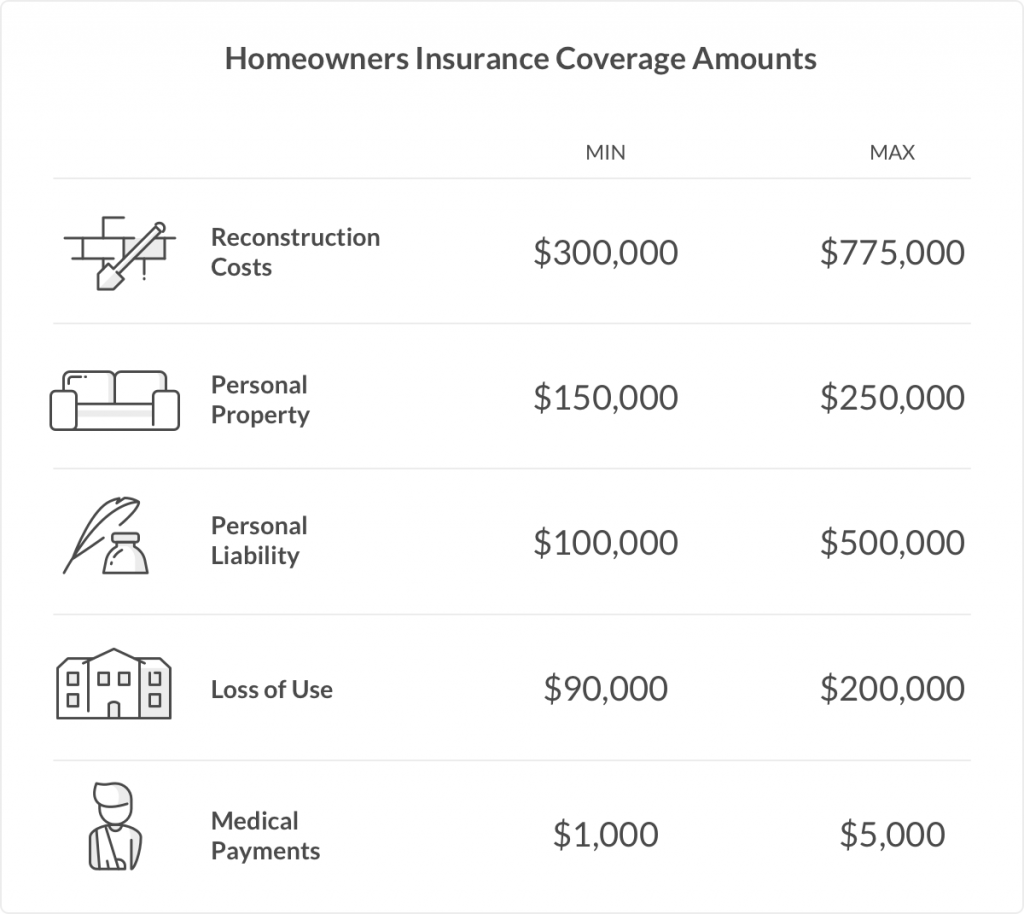

A form of insurance that protects your home your belongings and helps shield you from personal liability in case of disaster.

Homeowners insurance coverage meaning. The part of homeowners insurance that provides reimbursement for motel rooms meals and other expenses when loss of property by a covered peril forces you to maintain temporary residence elsewhere. What does dwelling insurance cover. Your homeowners coverage provides financial protection against risks including home fires burglaries and damage from storms.

Homeowners coverage can also protect your property some of your personal possessions and you. Homeowners insurance is exactly as it sounds. If you have a mortgage and your homeowners insurance coverage is insufficient lapsed or cancelled your mortgage lender has the right to force coverage.

Elevation before the fire occurred the foundation of your home will need to be raised. Homeowners insurance is a package policy. This includes damage caused by household pets.

Damage caused by most disasters is covered but there are exceptions. This helps by covering losses and damages to your home and personal belongings inside it. When you work with an independent agent you can get all of your questions answered and get a policy in place that meets your unique needs.

It also means you dont get a say in what that policy does and doesnt cover. Your standard homeowners insurance will repair and restore the damaged parts of your home up to your coverage limits. Dwelling coverage is the main component of homeowners insurance covering the physical structure of your home against perils or hazards spelled out in your policy.

Dwelling insurance also known as dwelling coverage or Coverage A is the portion of your homeowners policy that covers the costs to repair or rebuild your home after its damaged by a covered peril such as fire. Also called loss of use coverage. Simply put it is a protection on your investment and it provides financial peace of mind in the event of significant covered repairs.

What is homeowners insurance. Does it provide enough coverage for your liability and the risks to your assets. That means they buy a homeowners policy for you and youre responsible for paying the premiums.

But if a new building code requires your home to be at 10 ft. What is homeowners insurance. A homeowners insurance policy can protect your home against damages that occur to the house itself and the belongings inside.

This means that it covers both damage to property and liability or legal responsibility for any injuries and property damage policyholders or their families cause to other people. Most homeowners insurance policies cover damage or loss caused by the following perils.

Does Homeowners Insurance Cover Theft

What Is Isn T Covered Under Unendorsed Homeowners Policy

13 2 Packaging Coverage Homeowners Policy Forms And The Special Form Ho 3 Business Libretexts

Hazard Insurance Homeowners Dwelling Fire Policy Difference Portland Me Noyes Hall Allen Insurance

6 Best Homeowners Insurance Companies Of October 2021 Money

What Is Dwelling Insurance Coverage For Homes The Hartford

Does Homeowners Insurance Cover Theft

How To Read A Homeowners Insurance Policy The Zebra

Types Of Homeowners Insurance Hippo

Loss Of Use Coverage In Home Insurance Know The Rules

6 Best Homeowners Insurance Companies Of October 2021 Money

Understanding Your Home Insurance Declarations Page Policygenius

A Home Warranty And Home Insurance What S The Difference

Insurance Coverage Insurance Dictionary Insuropedia By Lemonade

What Does Homeowners Insurance Cover

What Is Dwelling Coverage Insuropedia By Lemonade

What Is The Difference Between Ho2 And Ho3 Homeowners Policies

Posting Komentar untuk "Homeowners Insurance Coverage Meaning"