Business Interruption Insurance Coverage Calculator

The equation for business income is. Basics of Business Interruption Coverage Section I 4.

Business Income Loss For Unprofitable Businesses Assurance Forensic Accounting

Business Interruption Presentation 1.

Business interruption insurance coverage calculator. Business income revenue - expenses. Equipment investment leased and purchased these values will be used to calculate your insurance coverage. One question being raised is whether insurance coverage might respond to virus-linked losses.

Ad Busca Cheap Insurance en GigaPromo. In anticipation of the need to prove financial loss Propel Insurance has created a COVID-19 Business Interruption calculator for Senior Care clients. Your coverage needs will depend on your projected loss of income and any extra expenses youll incur as a result of the loss.

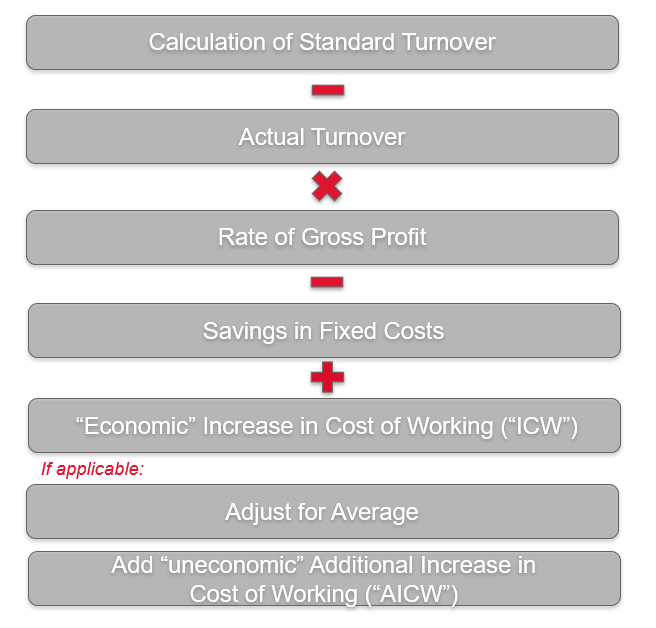

If you want to find out more about the business interruption insurance offered by Santam speak to your Relationship Manager or get in touch with SantamFor more advice tailored to intermediaries visit our intermediaries blog for useful product-related articles such as what private and commercial drone operators need to know about their. Every company has different accounting style but by large you will need to follow this formula to get to the BI indemnity. Business Interruption Loss Calculations.

The confusion lies on how to calculate adequate limit for this coverage. The insurance policy defines the terms of coverage. In addition Contingent Time Element Extended covers not only your immediate.

Youll usually find business interruption insurance sold as part of a business owners policy BOP which can cost anywhere between 500 to 3000 per year. Basics of business interruption coverage 2. Calculate the gross earnings of the business.

Ironically insurance policies define coverage but they never show how to put a claim together see Beyond the Policy. In its most general form this includes the following. Santam is always looking for innovative technology solutions to ensure our clients are properly covered.

MSM provide Independent pre loss advice in conjunction with your broker. Calculate the expected gross profits of the business over the indemnity period. Deduct taxes from this amount to find you businesss net income.

Factors for calculating your Business Interruption Coverage include. This calculates your businesss earnings before tax. Your net income will be your business income.

Business Interruption Insurance also called Business Income Insurance is coverage designed for when a company needs to close its doors after a disaster or unexpected circumstances. This figure is the result of the total revenues minus merchandise or materials consumed. This includes the potential for business interruption due to the presence of the virus on their premises employee absenteeism or supply chain disruptions.

This equals expected gross revenues minus expected changes in inventory values business material use and freight costs. Certainly the formula BI T x Q x V is never found in any policy. Other income could include but not be limited to rent interest and service fees.

This coverage is also useful to unlucky businesses when the city closes their street for major road construction. Calculate total revenues by adding net sales and other income that would be lost if normal business operations were interrupted. Today most insurance companies have moved the title of this coverage.

These things factor into the cost per year. B usiness I nterruption Insurance Coverage 2. A car assembly line is shutdown because the car parts supplier had a.

Welcome to MSM Business Interruption Calculator. MSM has experience across thousands of claims and has seen those programmes that fully respond and those that fall short. Our new Business Interruption Calculator is just tha.

No one can predict the future and with our business interruption insurance coverage you dont have to. Being able to calculate business interruption helps you ensure your company has enough protection to cover a period of downtime for your business from a short interruption to your worst-case scenario. How to present your claim effectively and achieve resolution with the insurance company 3.

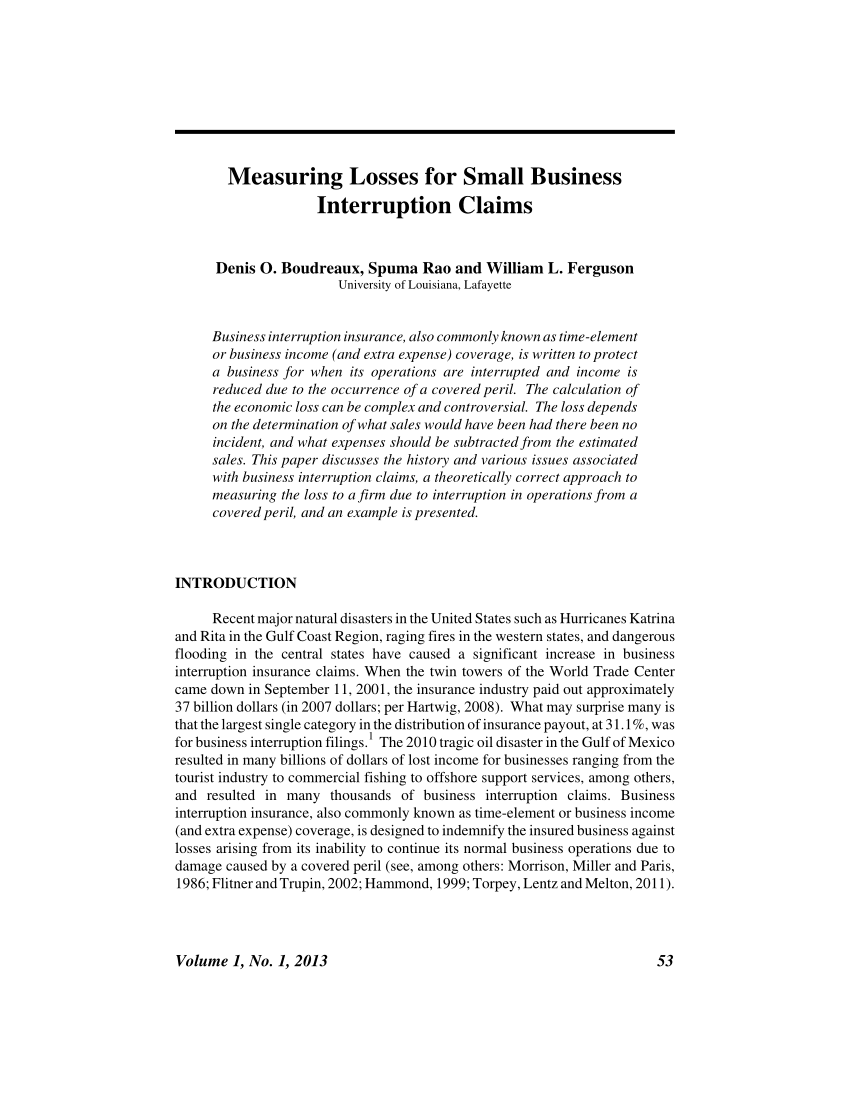

This worksheet will help care providers laser in on the adverse financial impact caused by these unprecedented events. Calculate the costs of moving to and operating your business from other temporary premises during the indemnity period. How to calculate the loss 3.

In the last issue of Claims Canada Education Forum featured 10 steps for examining and settling business interruption. Documenting a Business Interruption Claim February 2001. The key point of differentiation is that MSM provides an independent perspective.

BI T x Q x V BI Business interruption T the number of units whether it be hours days weeks that operations are halted. Basic Formula 2 Net Income Continuing Expenses ExtraAdditional Expenses Business Loss aka bottom up approach The other way to determine net income loss is to calculate the projected net income first. Subtract your businesss expenses and operating costs from your total revenue.

And you choose it after a loss occursrather than at policy inceptiononce all the details and impacts are known. Then add in all the expenses occurred by the business. Contingent Business Interruption 14 When a business cannot operate because a supply of goods or services necessary for operating the business has been disrupted.

With our Time Element Select option you choose whichever coverage best meets your needs. Then compare to actual income to determine the net income loss. This information is critical to calculating the insurance policy and becomes the basis of your business interruption insurance.

Industry Company size Coverage limits Location. Insurance coverage for loss of business income and extra expenses is typically provided when the loss is due to. Coverage for business interruption losses and related extra expenses are often included in property and casualty insurance policies.

The policyholders success in these situations is going to depend on understanding the business interruption formula of insurance. As the coverage evolved and improved over the years additional names were introduced. Business interruption insurance from Santam.

Business interruption losses are less tangible than direct physical losses. Business interruption insurance was the term used in the mid-1800s for the earliest versions of insurance for financial losses stemming from physical damage to an insureds own property. Compara y ahorra ahora.

Business Interruption Nsure Insurance

Business Interruption Insurance Compare Cheap Quotes

Processing A Business Interruption Commercial Property Insurance Claim

Business Interruption Insurance Calculation For Claims

How To Calculate The Right Amount Of Business Interruption Insurance Robertson Hall Insurance

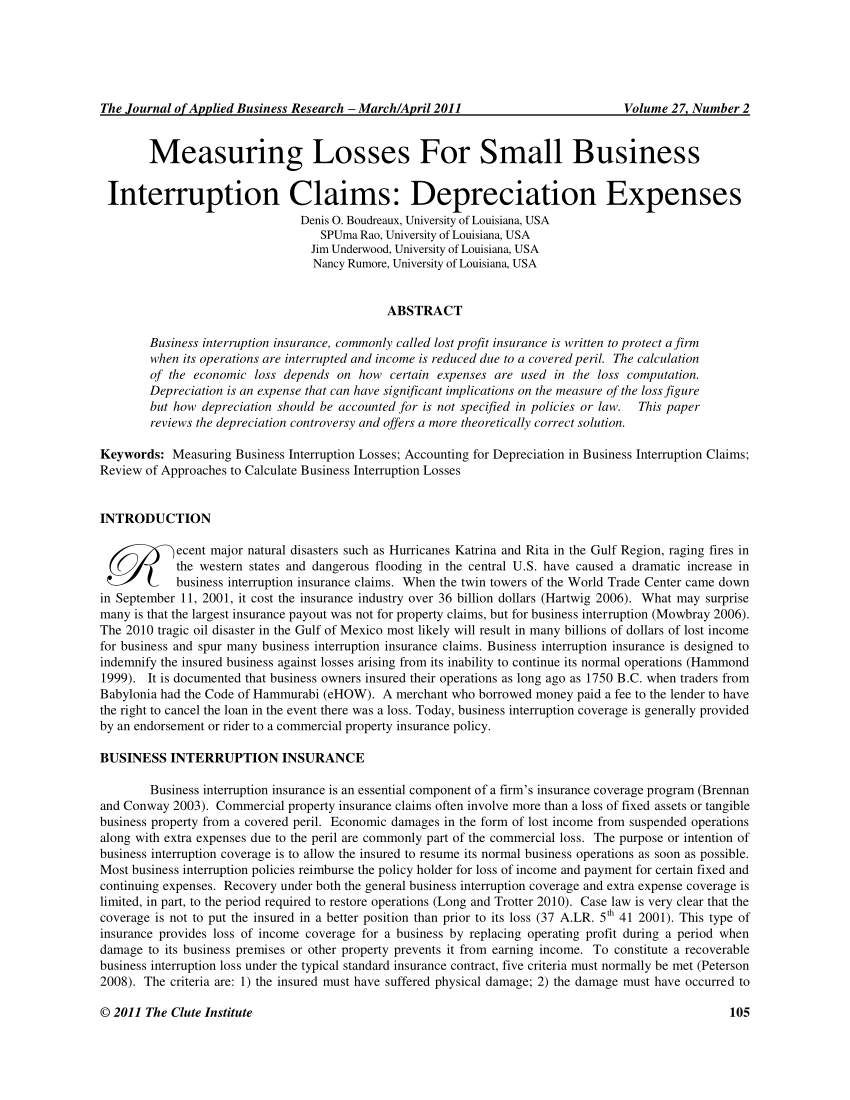

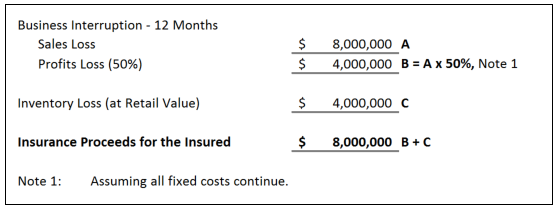

Pdf Measuring Losses For Small Business Interruption Claims Depreciation Expenses

Business Interruption Losses And Natural Catastrophes Mdd

How To Calculate Coverage For A Commercial Loss

Business Interruption Losses And Natural Catastrophes Mdd

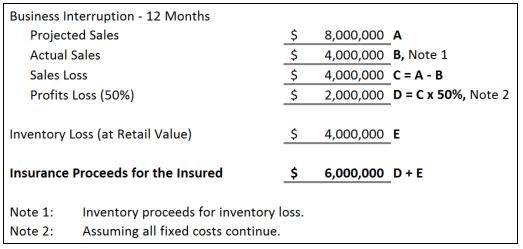

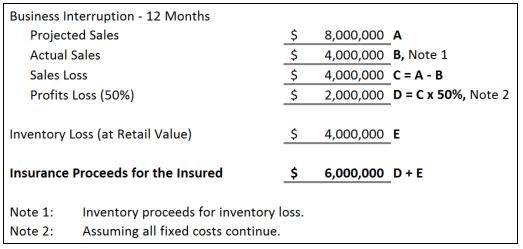

Inventory Losses Business Interruption Loss

Inventory Losses Business Interruption Loss

Business Interruption Calculator Youtube

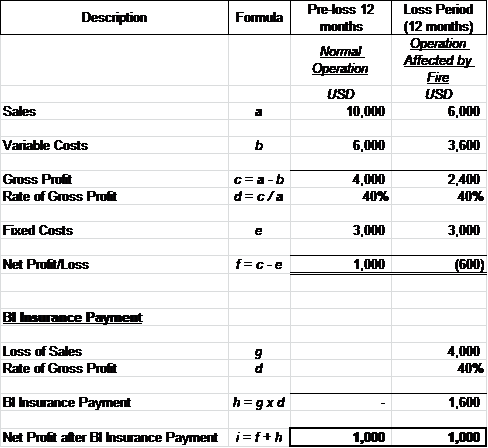

Business Interruption Insurance Calculation 2 Simple Methods

Pdf Measuring Losses For Small Business Interruption Claims

How To Calculate Coverage For A Commercial Loss

Business Interruption Presentation

Posting Komentar untuk "Business Interruption Insurance Coverage Calculator"