Mortgage Insurance Coverage Ratio

Yet with the MIP providing mortgage insurance to banks banks can provide mortgage loans with higher LTV ratio without incurring additional credit risk. That exceeds 90 so the required standard MI coverage is 30 for the 900195 LTV category.

What Is Pmi Understanding Private Mortgage Insurance

Expect to pay from 05 to 2 of your loan amount for your annual mortgage insurance premium.

Mortgage insurance coverage ratio. Its a simple calculation but very important. HFA Charter Coverage 20 Years 20 Years 20 Years 20 Years. MORTGAGE INSURANCE PROGRAMME PREMIUM RATE SHEET Insurance coverage from 60 LTV to 90 LTV OWNER-OCCUPIED RESIDENTIAL PROPERTY LOANS Mortgage Insurance Premium Mortgage Type Insurance coverage according to Loan-to-value Ratio LTV Original Loan Tenor Years Single Premium Payment of the Principal Balance Annual Premium Payment First Year.

Coverage ratios are commonly used by creditors and lenders Top Banks in the USA According to the US Federal Deposit Insurance Corporation there were 6799 FDIC-insured commercial banks in the USA as of February 2014. 6 MI LLPA. Mortgage insurance is an insurance policy which compensates lenders or investors in mortgage-backed securities for losses due to the default of a mortgage loan.

LTV and MI Coverage Ratios Fixed Rate Term 20 Years Fixed Rate Term 20. Without it mortgage rates would be higher as the risk of default would increase. The coverage ratio is sometimes referred to as the debt service coverage ratio DSCR or the interest coverage ratio and is used many times by lenders and commercial bankers to asses a companys ability to service their debt using proceeds from their net operating income.

Offer low rates minimal risk-based price adjustments compared to other programs and reduced mortgage insurance costs. All mortgage insurance protects the lender in case you default on your mortgage. 45 45.

The lender isnt really concerned much with individual credit scores or histories of the owners. As long as an application meets the relevant eligibility criteria eg. 18 MI LLPA.

Lenders are able to offer lower mortgage rates when mortgages are protected by mortgage. All property types including MH Advantage other than standard manufactured homes. PMI normally costs no more than 2 of your annual mortgage balance and often can be even cheaper.

LTV and MI Coverage Home Possible Mortgages. For a larger down payment. PHIF coverage is available only for conventional loans originated by Participating Lenders for purchase by the Pennsylvania Housing Finance Agency under the Single Family Mortgage Revenue Bond Programs.

For homeowners who are required to have PMI because of the 80 loan-to-value ratio rule they can request that the insurance policy be canceled once 20 of the principal balance has been paid off. Debt-to-Income ratioTo determine yours divide your monthly gross pre-tax income by the total of your regular required monthly payments for any installment student loan credit card and similar debts. 25 35 Fixed-rated term 20 years All ARMs.

Pricing The plan is a zero upfront monthly premium plan. HomeReady offers high loan-to-value LTV ratio financing to help homebuyers who would otherwise qualify for a mortgage but may not have the resources. The formula for coverage ratio is net operating income divided by total debt service.

Insurance coverage from 50 LTV to 90 LTV and applicable for property value up to HK6 million Mortgage Type Insurance coverage according to Loan-to-value Ratio LTV. When a lender looks at an apartment or multifamily property whether a mortgage will be granted and for how much could be determined using the DSCR or Debt Service Coverage Ratio. LTVCoverage 660-679 680-699 700-719 720-739 740-759 760 9501 970 35.

This loan uses a monthly premium MI plan requiring two months to be escrowed at closing that will be included in the closing costs that are added to the loan amount. Fannie Mae Standard Freddie Mac HomeOne Coverage. So lets say that a typical mortgage insurance rate ranges from 05 to 1.

Mortgage Insurance Coverage Requirements. A high CCR means the borrower has a better chance of getting the loan and that the collateral will pay off the loan in the case of default without putting other assets at risk. To secure the home you want to borrow 150000.

18 95 to 9001. 16 MI LLPA. To obtain High Ratio insurance your lender will pay the insurance premium.

How You Can Improve Collateral Coverage Ratio A business owner interprets CCR as helping to determine the amount of money that can be borrowed and the minimum amount of required collateral. Unless the lender has provided another charter-compliant form of credit enhancement the lender must obtain a primary mortgage insurance policy for a conventional first mortgage loan that has an LTV ratio greater than 80 at the time it is purchased for Fannie Maes portfolio or securitized. HomeReady Home Possible Coverage.

The policy is also known as a mortgage indemnity guarantee particularly in the UK. Although mortgage default insurance costs homebuyers 28 to 40 of their mortgage amount it does allow Canadians who might not otherwise be able to purchase homes access to the Canadian real estate market. For a 250000 mortgage that could be 1250 to.

Mortgage insurance can be either public or private depending upon the insurer. High Ratio insurance helps protect lenders against mortgage default and enables you to purchase a home with a down payment with as little as 5 with interest rates comparable to those with a 20 down payment. The maximum property value and the maximum loan amount etc the bank can provide a mortgage loan of up to 80 LTV ratio under the MIP.

Its not easy to calculate mortgage insurance yourself but its helpful to get a sense of your general range to guide your expectations. Fixed-rate term 20 years. Your lender will usually pass this cost on to you.

12 MI LLPA. Mortgage Insurance Coverage Options Matrix C Standard Mortgage Insurance MI ustom Mortgage Insurance MI Alternative to standard MI with a credit fee in price1 Loan Product Advisor Accept Risk Class Home Possible Mortgages.

5 Types Of Private Mortgage Insurance Pmi

Changes To Virginia Housing S Fannie Mae Reduced Mi Program Vhda

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance4-032e9dfa86f4428395ca45cbb2628baf.png)

How To Outsmart Private Mortgage Insurance

What Is A Private Mortgage Insurance On Mortgage In Nyc Nestapple

5 Types Of Private Mortgage Insurance Pmi

What Is Pmi Understanding Private Mortgage Insurance

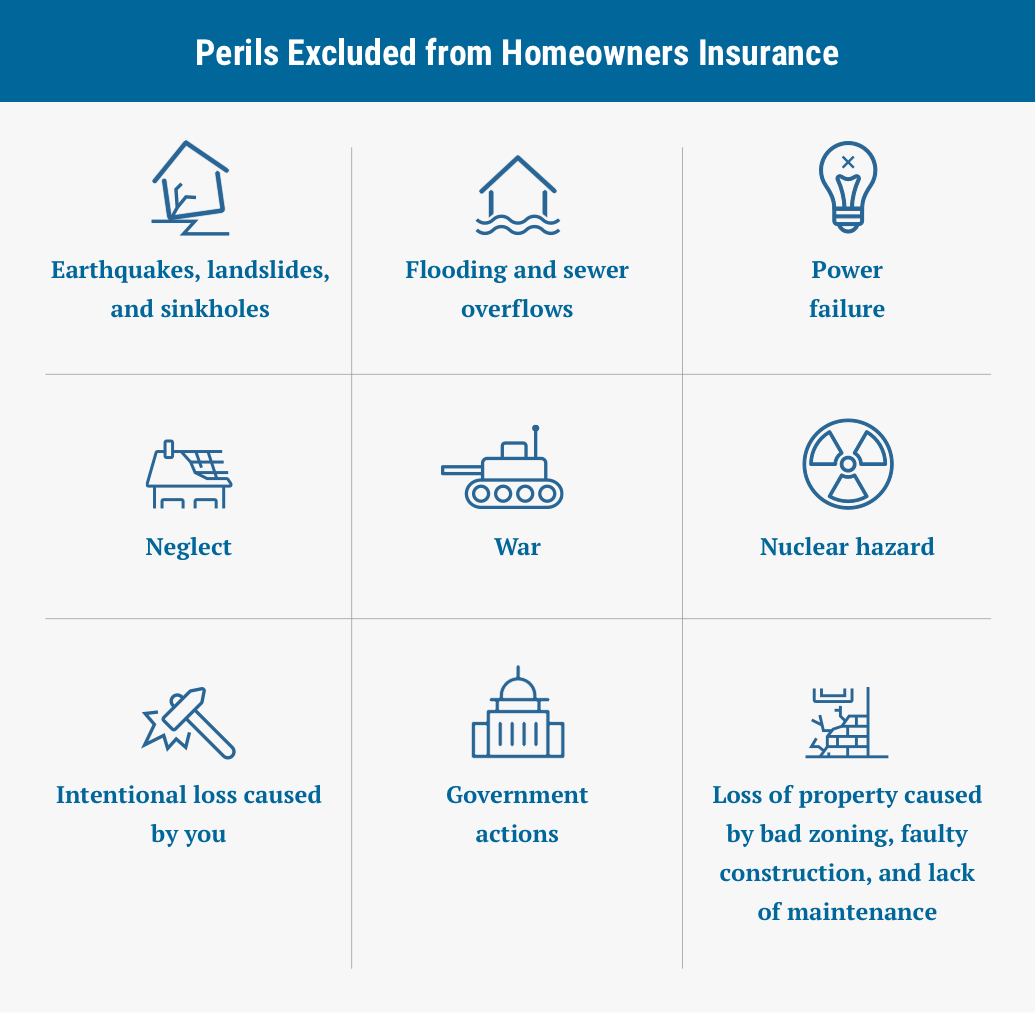

Homeowners Insurance How It Works And What S Actually Covered

Private Mortgage Insurance Pmi When It S Required And How To Remove It

What Is Mortgage Life Insurance

What Is Mortgage Insurance And How Much Is Mortgage Insurance

5 Types Of Private Mortgage Insurance Pmi

Private Mortgage Insurance Alameda Mortgage Corp Home Loans Simi Valley Ca

Chart Fha Annual Mortgage Insurance Premiums Mip For 2019

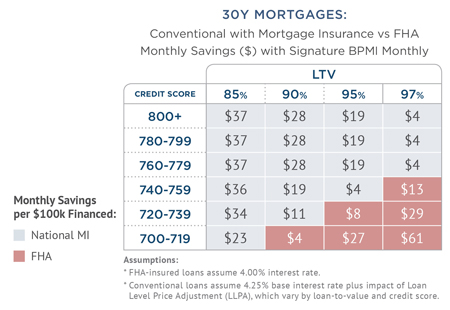

Private Mortgage Insurance Vs Fha National Mi

6 Best Homeowners Insurance Companies Of October 2021 Money

We Don T Charge You Mortgage Insurance Cmhc

What Is Pmi Understanding Private Mortgage Insurance

/shutterstock_532025803.mortgage.insurance.cropped-5bfc314046e0fb00265cf926.jpg)

5 Types Of Private Mortgage Insurance Pmi

Posting Komentar untuk "Mortgage Insurance Coverage Ratio"