Renters Insurance Cover Job Loss

Unfortunately a renters policy does not offer coverage for loss of employment for any circumstance. Renters insurance does not cover property damage for all perils.

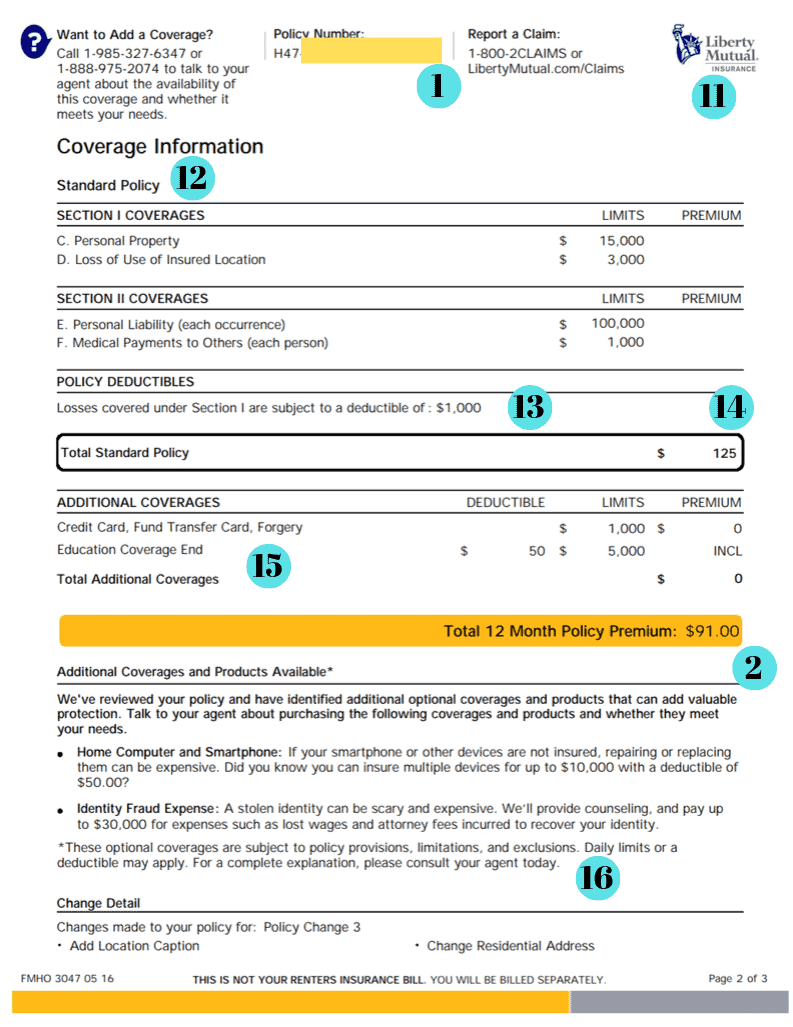

1099 Vs W2 Educational Infographic Social Media Infographic Business Insurance

For renters responsible enough to invest in renters insurance to financially protect their possessions and liability they may be able to buy job loss insurance.

Renters insurance cover job loss. You also have coverage if your personal property is damaged. Renters insurance provides cash payments when disasters damage or destroy property. In fact the average renters insurance premium is only 180 per year or 15 per month.

Some policies will provide rental assistance under certain circumstances. Some insurers sell rent loss insurance separately but it is included in many general landlord insurance policies. Renters insurance can cover the contents within a home including all of your valuable belongings following an insured event.

Renters insurance tends to cover loss or damage to items in the home related to fire theft vandalism plumbing and electrical malfunctions. If you are injured in an auto accident your PIP may cover. This type of job loss insurance isnt private mortgage insurance.

Renters insurance loss of use is also known as additional living expenses. Unfortunately the answer is no. Typically renters insurance covers the loss of food from either a mechanical or power failure in your rental.

You will need insurance to cover your rental units for liability and property damage. Renters polices are designed to protect your personal property and to give you liability protection if you are sued for bodily injury or property damage you may have caused to another party. 6 days ago The answer is an unequivocal No Renters insurance does not cover job loss for the named insured.

Its designed to make sure that a covered loss doesnt cause you to incur additional costs that you shouldnt have to bear. As a result your coverage levels are far greater than the average renters insurance policy which costs around 190 per year. Some people think of the policy as a luxury and its one of the first things to go because it doesnt cover job loss and it.

What does renters insurance cover. Basic renters insurance policies are made up of several coverage components and cover a range of types of losses. Renters insurance does not cover job loss for the named insured.

Renters insurance does still cover you regardless of whether youre employed or not. A typical renters insurance policy for example will cover 30000 in personal property damage and 100000 in liability costs with these limitations adjustable based on your needs. Renters insurance polices do not cover job loss.

There may be some protections afforded to you by PayPal but you would not be able to claim the watch under your renters insurance. Bed bugs and pests. But it would not cover you in a fraudulent sales transaction.

You may be surprised to learn that your landlords insurance doesnt cover damage or loss to your property. Most renters insurance policies will not cover damage costs associated with bed bugs with limited exceptions. You have coverage if you are sued for personal injury or property damage.

Renters insurance does not cover job loss for the named insured. A renters policy will typically provide replacement cost coverage for personal property damaged by a covered loss such as fire smoke covered water damages theft and it likely offers many other protections youve not considered. Renters insurance covers you your liability and your belongings in the event of a covered loss.

Renters insurance coverage is broken down into four coverage types. Another difference between this insurance type and rent loss insurance is that a rent guarantee insurance policy will cover the base rent amount that was being paid by the tenant monthly whereas rent loss insurance will not. A renters insurance policy helps bridge the gap to make sure tenants have adequate property and liability coverage for those items not covered under a landlords policy.

This includes protection of your contents from unpredictable weather and the impacts of cyclones floods storms and bushfires. Also there are coverages for loss of use should you be dislocated from your premises due to a covered peril. Renters insurance will rarelyor nevercover damage to your personal property for some specific perils such as earthquakes riots and pests.

Job loss is generally not a loss of physical property and would therefore not be covered. Job loss insurance is a rider that renters can add to their renters insurance policy that provides them with some financial assistance so they wont have to miss their rent payments and lose their home states the article. Private mortgage insurance safeguards your lender if you cant pay your mortgage.

Your renters insurance policy will reimburse you for damaged or destroyed personal property up to your coverage limits. Job loss mortgage insurance pays your monthly mortgage payment for a specified period while youre out of work. Renters can purchase flood insurance to help cover the cost of replacing belongings if they are damaged by floodwater.

Renters Insurance Cover Job Loss. From job loss to abandonment the reason for the nonpayment doesnt factor into the insurance coverage. Renters insurance also protects you against things like theft damage and legal liability.

If you have specific concerns contact your agent for guidance. If you read the policy youll see that the entire fifty or so page policy document is completely silent on the subject of your employment. Below is a list of four items covered under most renters insurance policies.

Insurance payments can help you get by until you replace your possessions or even cover the full cost of buying new ones. This coverage helps pay for the cost of legal fees lost wages and other related costs if someone steals your identity. Renters Insurance Cover Job Loss Personal property loss over your coverage limitI had a fire from a lightning strike on a nearby treeWhat does renters insurance coverIn the event of a loss your claim will be divided equally among everyone listed on the policy.

Personal property coverage personal liability additional living expenses and medical payments insurance. Renters insurance will cover theft such as if someone steals your watch from your home or your vehicle. A renters policy has two major types of coverage.

Here are answers to a few common questions about the unexpected uses of renters insurance.

Lemonade S Amazing Coverage Protects The Stuff You Own At Home And Everywhere Else Social App Design Website Inspiration Best Landing Page Design

The Importance Of Renters Insurance Geico Living

Social Security Disability Website Renters Insurance Quotes Life Insurance Uk Social Security Disability

9 Best Renters Insurance Of 2021 Money

What Is Renters Insurance The Ultimate Guide

How To File A Renters Insurance Claim In 2021 U S News

Difference Between Pdlw And Renter S Insurance With Table

Company Disputed Claim Autos Send Covering Letter Health Insurance Claims How Submit Your With Tpa Insurance Car Insurance Lettering

Is Renters Insurance Worth It What It Covers And What It Doesn T Avail

Is Renters Insurance Worth It What It Covers And What It Doesn T Avail

Do I Really Need Jewelry Insurance Infographic Lavalier Jewelry Insurance Hunting Tips Infographic

What Is Renters Insurance And How Much Do You Need

Home Buyers Guide To Home Insurance Visual Ly Home Insurance Homeowners Insurance Home Buying

Nationwide Renters Insurance Review The Simple Dollar Renters Insurance Quotes Renters Insurance Homeowners Insurance

Home Insurance Landing Page 190810 Home Insurance Travel Insurance Car Insurance

Is Renters Insurance Worth It What It Covers And What It Doesn T Avail

Renters Insurance In A Nutshell Renters Insurance Insurance Marketing Tenant Insurance

Posting Komentar untuk "Renters Insurance Cover Job Loss"